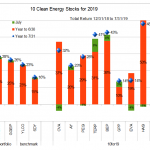

Ten Clean Energy Stocks For 2019: Marginally Hotter

by Tom Konrad Ph.D., CFA

July 2019 was “marginally” the warmest month on record. Meanwhile, the stock market was also inching to new highs, and the real, sweltering evidence of climate change continues to let clean energy income stocks turn in a blistering performance.

While my broad income stock benchmark SDY was up 16.0% through the end of July (0.9% for the month), my clean energy income stock benchmark YLCO is up 23.4% through July (0.4% for the month,) My 10 Clean Energy Stocks model portfolio is up 28.3% (1.3%) and my real-money managed strategy, GGEIP, is up 26.4% (1.2%) for...

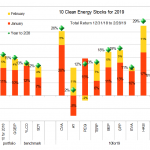

October Undoes September: Ten Clean Energy Stocks For 2015

Tom Konrad Ph.D., CFA In the two months since my last "monthly" update, clean energy stocks fell precipitously in September and then recovered most of those losses in October, although not for the year. Income focused Yieldcos have been particularly badly hit, but my income heavy Ten Clean Energy Stocks for 2015 model portfolio has done quite well in spite of this. I attribute this resilience to my emphasis on current dividend income, rather than the dividend plus double-digit growth that many Yieldcos were promising before the collapse in their stock prices rendered...

10 Clean Energy Stocks For 2016

Tom Konrad CFA The History and Future of the "10 Clean Energy Stocks" Model Portfolios 2016 will be the eighth and possibly final year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in managed accounts), the model...

Veolia Cleaning Up Balance Sheet

Tom Konrad CFA On Thursday, Veolia Environnement (NYSE:VE) closed a deal to sell its solid waste business for $1.9 billion. This is part of its ongoing effort to reduce debt and cost of operations by selling assets worth $6.14 billion, which the company expects to complete by the end of 2013. Last year, Veolia took the first step in this program by selling its UK water business, also for $1.9 billion. I’ve long been attracted to Veolia for its green credentials and high dividend yield. The company paid a euro 0.70 ($0.85) dividend in 2012,...

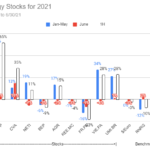

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

Q2 Performance Update: 10 Clean Energy Stocks for 2009

The Obama Effect continues to make my annual ten picks shine. Tom Konrad, Ph.D., CFA This is the second performance update on my 10 Clean Energy Stocks for 2009. In the first quarter, the model portfolio was up a tiny 1.6%, but still managed to beat the benchmarks handily (by 8% and 9%), since they were both down significantly. In the last three months, the market has turned around, logging significant gains, but my ten picks have continued to outperform. Company Ticker Change 12/27/08 to 7/2/09 Dividend & Interest The...

Finding a Bottom and Model Portfolio First Half Returns

By Tom Konrad, Ph.D., CFA

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and...

Ten Clean Energy Stocks For 2015: Income Comes In First; Growth Shrinks

Tom Konrad Ph.D., CFA 2015 was a very tough year for energy stocks, especially income oriented energy stocks such as (mostly fossil fuel) MLPs and (mostly clean energy) Yieldcos. Not only did oil and gas prices drop dramatically, but most other commodities did as well. Low commodity prices hurt commodity producers, but also commodity recyclers and efficiency companies that help reduce the consumption. Against this backdrop, I'm happy that my Ten Clean Energy Stocks for 2015 model portfolio ended the year in the black, with a 5.8%...

Earnings Season For Ten Clean Energy Stocks

Tom Konrad CFA The third quarter earnings season has been quite eventful for my Ten Clean Energy Stocks for 2013 and six alternative picks model portfolios, so much so that writing about them has taken a back seat to keeping up with the announcements. There were a number of earnings disappointments and earnings announcements which were in line with my expectations but the market treated like disappointments. These resulted in an overall decline of 2.5% for the portfolio since the last update, even as my industry benchmarks, the Powershares Wilderhill Clean Energy (PBW) and my...

10 Clean Energy Stocks For 2019 – First Two Months Results

It's hard to find anything to complain about in the first two month's performance of my 10 Clean Energy Stocks for 2019 model portfolio. Unfortunately, I'm about to go on vacation and don't have time to do an update on all the earnings reports that have come out over the last two weeks. I will try to get to them individually as I have time.

Strategically, I'd like to say I'm getting very nervous about this market rally, and think that readers should be taking profits opportunistically and increasing your cash positions.

Ten Clean Energy Stocks for 2010: Third Quarter Update

Tom Konrad CFA I like to think that one of the things that distinguishes me from the mass of investment bloggers and newsletter writers is that I write about my mistakes, as well as my great calls. This is not just a service to readers, but a service to myself. Overconfidence and why I write about my mistakes One of the most pernicious cognitive errors common among stock market investors arises from our wish to see ourselves as great investors. One of the ways we accomplish that goal is to selectively and unconsciously self-edit our...

Ten Clean and Green Energy Stocks for 2011

Tom Konrad, CFA My annual mini-portfolio of clean energy stocks which I expect to outperform in 2011. This is my fourth annual list of renewable energy and energy efficiency stocks since I began the series in January 2008. The Purpose of this List For myself, these lists serve as a record of my thinking on the market which I can look back on and learn from over the following year. When I publish the list, I state my reasons for selecting each stock, and then track the portfolio's performance over the following year in...

10 Clean Energy Stocks for 2011: It’s 2008 All Over Again

Tom Konrad CFA Few investors have good memories of 2008, but when it comes to the performance of my annual model portfolio of ten clean energy stocks, I'm finding the resemblance to 2008 remarkably striking. The good part of that memory is that my picks are once again out-performing my clean energy benchmark, the PowerShares Clean Energy ETF (PBW). The bad news is that "out-performance" means down 44% for the portfolio, compared to down 48% for PBW: a Pyrrhic victory. Over the same period, the broad market Russell 2000 index was down 22%. For 2008,...

Ten Green Energy Gambles for 2010: Update 2

Tom Konrad, CFA The stock market is up, and my bets against it are down, except in energy. It's time to double down. Earlier this week, a client asked me if I'd found any buying opportunities while doing research for my "Best Peak Oil Investments" series. The answer is, "no," although I've found a few companies I'm hoping to buy at lower prices, later. As regular readers know, I've been bearish since June 2009, after I cashed in on the quick rally in March, April, and May of that year. My last ten months of...

My Portfolio’s Latest Casualty And Addition

The Casualty Last Monday, I discussed how I had recently reviewed Railpower Tech with a view to potentially adding to my position on grounds that: (a) the company had a fair amount of cash in the bank, which reduced the need to go to capital markets for financing for a while; and (b) that it was getting badly battered by general market conditions, potentially offering an attractive entry point. Although my portfolio has taken a beating in recent weeks, I remain ready to take small positions in stocks if I feel they are being unfairly bashed, including in...

PowerShares WilderHill Clean Energy ETF Constituents

The Energy Stock Blog has posted an update of the stocks that make up the PowerShares WilderHill Clean Energy ETF (PBW). The only change that I see from the last reporting of the index is the addition of Pacific Ethanol, Inc. (PEIX) to the portfolio.