Too Good To Last? Ten Clean Energy Stocks For 2019

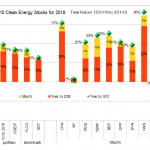

The first quarter of 2019 saw the market's largest quarterly gain in a decade, and my 10 clean energy stocks model portfolio outperformed both the broad market and the clean energy income ETF I use as a benchmark (see chart above.)

Performance that strong makes me nervous, especially since the last time we saw gains like these it was the stock market rebound from the financial crisis. In this case, while the market was down in the last quarter of 2018, it had only been enough of a decline to blow a little of the foam off the top of...

Ten Clean Energy Stocks For 2016: Just The Numbers (9-1 to 10-11-16)

Tom Konrad, Ph.D., CFA I missed my regular monthly update of my Ten Clean Energy Stocks for 2016 model portfolio at the start of October due to vacation. This mini-update will just give the numbers through October 11th, without the regular discussion of company events. I'll follow up in early November covering highlights for the full two months. As you can see from the chart below, the portfolio and all sub-portfolios did very well by outperforming their benchmarks by 3% to 12% for the six week period. See the May...

Clean Energy Tracking Portfolio Update: Oops!

My Quick Clean Energy Tracking Portfolio has solidly outperformed its benchmark... was it bad design? Tom Konrad, Ph.D. On February 27, I used the top holdings of the (then six) clean energy mutual funds to design a tracking portfolio intended to replicate the performance of those funds at much lower cost. If my methodology was sound, the tracking portfolio should produce returns within the range of returns of the mutual funds on which it was based. If all went well, the returns would be at the upper end of that range because of the way I chose to emphasize...

Four Clean Energy Value Stocks I’m Buying Now

Tom Konrad CFA Corrected version 8/11/2011 Apologies to readers who have been missing my articles recently. I've had little time to write as I have been too busy trading. Long-time readers know that I've been bearish since the summer of 2009, and it has been a painful two years as I maintained my short positions and puts in the face of a generally rising market. Market Outlook In my opinion, we are still a good distance from the bottom. The rise of the stock market over the last two years has been predicated on...

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Ten Green Gambles for 2010: Q3 Update

Tom Konrad CFA To my surprise, the market came back in the 3rd Quarter, and my portfolio of put options designed to hedge a market decline is predictably down. However, my benchmark (a put against the Dow Jones Industrials has performed even worse than my picks.) I don't have a lot to say about the performance of my Ten Green Gambles for 2010 so far this year. These gambles were a bet on a market decline in 2010. Since we're now into the 4th quarter and the market is still...

The Peak Coal Portfolio

Last week, we alerted you to a report from Germany's Energy Watch Group called “Coal: Resources and Future Production,��? which predicts peak coal by 2025. Readers of AltEnergyStocks are doubtless familiar with peak oil, the inevitable fact that as we consume a finite resource (oil reserves) at some point the rate of that consumption must peak, and taper off. Serious arguments about peak oil center around "when" oil production (and consumption) will peak, not "if." The same it true for other finite natural resources, such as natural gas, uranium, and even coal. The difference with coal is the received...

Ten Clean Energy Stocks For 2014

A list of ten high yield and value clean and alternative energy stocks expected to do well in 2014.

A Great Day For Solar Stocks, But Beware The Volatility!

Is it the unprecedented amount of media attention climate change is currently getting? Is it the State of the Union Address? Is it the price of oil? Or is it a combination of factors? In the end, it doesn't really matter; it's this time of year again and the value of the solar sector is heading north. Today was a great day for solar stocks, while the market as a whole was mainly flat. I remember this period last year very well. I was long Suntech Power and Energy Conversion Devices , acquired...

Shares in Active Power Purchased

I currently don't have time to do a complete writeup on this stock, but wanted to let everyone know that I purchased shares in Active Power Inc (ACPW) this afternoon for both my personal portfolio and the mutual fund. The average price was at $3.77. I will updated this post later this afternoon with more details. Updated at 10:00 PM As I mentioned above I purchased shares in Active Power Inc (ACPW) this afternoon for both the mutual fund and my personal portfolio. Active Power designs and sells battery-free uninterruptible power supply (UPS) systems....

The Year of the Balance Sheet

Year in Review: Ten Green Energy Gambles for 2009 Tom Konrad, CFA My speculative renewable and alternative energy stock picks for 2009 had mixed results. The gambles came nowhere near the performance of my 10 Clean Energy Stocks for 2009, and only kept pace with their benchmarks. The reasons why can be found on the companies' balance sheets and cash flow statements. In January 2009 in response to popular demand, I gave readers ten picks of speculative green energy stocks. I tend to buck the general trend that renewable energy investors tend to be gamblers, but my annual stock...

Ten Clean Energy Stocks for 2010: The Year in Review

Tom Konrad CFA My ten annual stock picks have outperformed their clean energy benchmark for the third year running. Each year, I publish a list of ten renewable energy, energy efficiency, and cleantech stocks that I feel will outperform their peers in the coming year. In both 2008 and 2009, my picks have beaten their industry benchmark, the PowerShares Wilderhill Clean Energy ETF (PBW), the most widely held industry ETF and the one that I recommend for making short-term bets on the clean energy industry. The 2010 list is here. This year has been an interesting...

Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...

Ten Clean Energy Stocks For 2016: Quick July Update

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio had yet another strong month, as did my real managed portfolio, the Green Global Equity Income Portfolio (GGEIP.) The shorter-format of last month's update turned out to be popular, so I'm doing it again. July Total Return July Benchmark Return YTD Total Return YTD Benchmark Return 10 Clean Energy Stocks 8.5% 5.5% 15.3% ...

What’s Going On With Beacon Power and RailPower Tech?

Two diametrically-opposed stories for this post: Beacon Power and RailPower Tech . The latter is up 134% on its week-ago closing price, while the former is down nearly 22% over the same period. Beacon Power Corp I wrote about Beacon Power a little while ago. The recent drop in share price is due in large part to the fact that Beacon announced, last Friday (Dec. 29), a glitch at one of its testing facilities in Massachusetts. This was followed by an analyst at Merriman Curhan Ford downgrading the company from Buy to Hold. Almost immediately, the...

Give the Gift of a Future This Christmas: Five Sustainable Companies For Your Kids...

A Carbon Conundrum for Christmas Do we have to choose between happy kids this Christmas, and a happy future for those kids? Practically everything we buy has a negative environmental impact. If green consumption is an oxymoron, so is green giving. Are we left with only greener giving? It often seems that the only way to be truly green is to be like the Grinch (before his heart-enlargement) and not give anyone anything. And skip the tree while you're at it. It's a hard decision, and while there are many Green Shopping Advisories telling us that we can buy...