Ten Clean Energy Stocks For 2014: September Swoon

Tom Konrad CFA Worries including the conflict with ISIL, Ebola, and economic slow-down in Europe, sent the stock market down in the month to October 3rd, with small cap stocks and clean energy stocks falling even farther than the large cap S&P 500. My 10 Clean Energy Stocks for 2014 model portfolio weathered the storm relatively well because of its emphasis on defensive and income stocks. Since the last update, the model portfolio was down 4.8%,...

What 11 Clean Energy Stocks Did on My Summer Vacation

Tom Konrad CFA August Overview I was traveling for much of the month of August, and so did not keep up with most of my stocks. But not much happened while I was gone, with the broad market and renewable energy stocks both producing small gains for the month of a little over three percent, as measured by my benchmarks, the Russell 2000 index (^RUT, 3.4%), and the most widely held clean energy ETF, the Powershares Wilderhill Clean Energy ETF (PBW, 3.2%). My Clean Energy model portfolio also had a relatively uneventful month,...

10 Clean Energy Stocks for 2015- September Performance

by Tom Konrad Ph.D., CFA Sorry I did not have time to write the usual monthly update article this weekend, but I hope to get to it in the next couple weeks. Until then, here is how the stocks were doing through the end of September (click for larger version): The recent market downturn continues to make my relatively conservative picks (especially the income stocks) generally outperform. For the year, the model portfolio is down only 6% in dollar terms compared to its clean energy benchmark, which is down 30%, and almost...

Ten Green Energy Gambles for 2010: Update 2

Tom Konrad, CFA The stock market is up, and my bets against it are down, except in energy. It's time to double down. Earlier this week, a client asked me if I'd found any buying opportunities while doing research for my "Best Peak Oil Investments" series. The answer is, "no," although I've found a few companies I'm hoping to buy at lower prices, later. As regular readers know, I've been bearish since June 2009, after I cashed in on the quick rally in March, April, and May of that year. My last ten months of...

Green Dividend Values (11 Clean Energy Stocks for 2012)

Tom Konrad CFA Performance in May Fear of the disintegration of the Euro resurfaced in May, sending all stocks downward. Clean energy stocks once again fell more than the market as a whole. Possible causes are that many clean energy sectors are exposed to further loss of European subsidies, and that clean energy stocks tend to be more volatile than the market as a whole, with both up and down moves being magnified. The Russell 2000 index (which I use as a broad market benchmark in this series) was down 7.1% in May, the Powershares Wilderhill Clean...

Value Trapped: Ten Clean Energy Stocks For 2015, April Update

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio held on to first quarter gains in April, despite a 29% fall for one of the stocks. (For details on that decline, see the Power REIT (NYSE:PW) section below.) The portfolio as a whole was rescued by the recovering Canadian Dollar and Euro, as well as mild advances for most of the other stocks across the board. That includes a 4.9% gain for TransAlta Renewables (TSX:RNW, OTC:TRSWF), and a 5.8% gain for FutureFuel (NYSE:FF) which I singled out...

Four American Stocks for the Next Economy

Garvin Jabusch The Green Alpha Advisors' approach to portfolio management utilizes a top-down macroeconomic model reflecting how global economies will evolve to meet demands presented by modern challenges such as resource scarcity, growing populations, land and food management, atmospheric carbon and extreme weather, to name a few. These emerging challenges are daunting, but fortunately, society is answering and acting to preserve our economies and way of life with a new wave of innovation, the like of which has not been seen since the information technology revolution of the 1990s and the industrial revolution before that. The...

Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

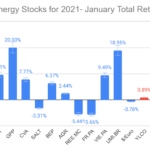

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

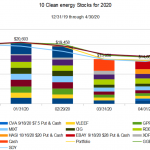

10 for 2020 Preview

by Tom Konrad, Ph.D., CFA

Over the last couple years, I've given paying subscribers a chance to see my annual list one trading day early. I did not get it organized this year, but I just got an email from a past participant who was interested. I initially said no, I'd rather be fair to all readers but then I thought maybe there are others who can benefit.

I currently have a list of 11 stocks, which I will be narrowing down to 10 after the close on Dec 31st. Anyone who forwards me (tom@thiswebsite.com) an email confirming a donation in...

December Update: 11 Clean Energy Stocks for 2012

Tom Konrad CFA What the Election Brought to Energy Stocks Obama's reelection did not bring on a new bull market for Clean Energy stocks, as some had hoped. My Clean Energy model portfolio was flat (+0.4%) for the month, while the widely held Powershares Wilderhill Clean Energy ETF (PBW) fell 1.6%. In contrast, the broad market, as measured by the Russell 2000 ETF, (IWM) rose 1.1%. If Obama's re-election had a strong effect on any energy sector, it was coal stocks: the Market Vectors Coal ETF (KOL) was down 8.5% over the same...

The Alternative Energy Stocks Paper Portfolio

Here at AltEnergyStocks we try to give the best advice to help our readers sort quality alternative energy investments from the simply overvalued and the dangerous poseurs. How well are we doing? Putting Play Money Where our Mouth Is. As regular readers know, both Charles and I invest in many of the same stocks we recommend. I take a broad portfolio approach, with small stakes in almost everything I think is interesting, and larger stakes in companies I'm more bullish about, while Charles has a highly focused portfolio consisting of a small number of companies he expects to perform...

Ten Clean Energy Stocks For 2016: Quick July Update

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio had yet another strong month, as did my real managed portfolio, the Green Global Equity Income Portfolio (GGEIP.) The shorter-format of last month's update turned out to be popular, so I'm doing it again. July Total Return July Benchmark Return YTD Total Return YTD Benchmark Return 10 Clean Energy Stocks 8.5% 5.5% 15.3% ...

Woulda, Coulda, Shoulda

With the market's rapid rebound from March lows and the Nasdaq Composite stock index closing higher than it was at the end of last year, many of us are probably asking ourselves:

Did I miss my chance to buy at the lows?

or:

Will I ever make up for my losses?

These questions point to dangerous emotions for stock market investors. Fear of missing out often leads to investment mistakes. This is why investment advisors always tell their clients that they are better off not looking at their portfolios in a downturn.

A big loss makes some people want to sell everything, for fear...

Is XsunX (XSNX) Being Manipulated?

Hans Deuel at Clearfish Research presents some very good concerns about the possible manipulation of the shares of XSUNX Inc. (XSNX). I've received a number of comments about XsunX, all from the same person. I decided to look into them. They are working on transparent solar cells, have a weird history, and a weird structure. The only technological information I can find on them is all paid advertising (from IPODesktop and others) masquerading as research. Each of their press releases are misleading. They offer one key statement, and then go on about intentions. For example, the latest one...

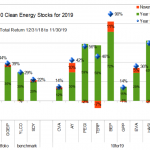

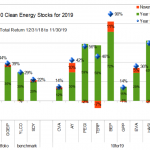

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...