Roundtable Greenlights Effort on Renewable Energy Covered Bonds

by Sean Kidney “There is more liquidity than ever being put into the system, but funds are still not being allocated to renewable energy projects” “The bottleneck for renewable energy is not in construction financing but a year or two after construction .” “ is not an asset class where risk changes over time – it changes between pre-completion to post-completion stages… it is incorrect to think that offloading an asset post-completion dumps risk onto others because the riskier part of the project is past.” “Alignment of interest with investors is strong as the issuing bank...

Yieldcos: Calling The Bottom

by Tom Konrad Ph.D., CFA On a podcast recorded on September 14th, I said I thought that Yieldco stocks had bottomed at the end of September. Two weeks later, that call still looks like a good one (see chart.) I'm starting to hear optimistic noises from other Yieldco observers, although the general tone remains quite bearish. Why do I think September 29th was the likely bottom? End of quarter. Some institutional investors such as mutual funds reshuffle their portfolios at the end of the quarter so that they don't have...

YieldCo Bubble: The Aftermath

Readers may be interested in listening to this podcast. Where Stephen Lacey and Shayle Kann of GreenTechMedia speak with me about the current YieldCo landscape. Follow this link to The Interchange Podcast. -Tom Konrad, Editor

Northland Power’s Solar-Backed Bond

New Canadian Climate bond: Northland Power releases a pretty big ABS - CA$232m (US$206m) - backed by solar projects with proceeds for renewables. 18-year tenor, 4.397% coupon, BBB. Securitisation key future area for green bonds.

Royalties: a Financial Innovation for Renewable Energy

The following interview with RE Royalties (RE.V, RROYF) CEO Bernard Tan was conducted in September by AltEnergyStocks.com Editor Tom Konrad. Links and ticker symbols were not included in his original responses, but added by AltEnergyStocks.com as a resource for readers.

Q: What exactly is a renewable energy royalty?

A renewable energy royalty is a stream of cash flows generated by a renewable energy project. When the project generates electricity and sells its electricity, we receive a percentage of the revenues from the electricity sales, otherwise known as a gross revenue royalty. We receive that gross revenue royalty, on average, for about...

Fifteen Clean Energy Yield Cos, Created Unequal

Tom Konrad CFA Renewable Energy Investing Grows Up. In January I predicted 2014 would be the year "renewable energy finance comes of age." Here's how Jennifer Runyon quoted me on Renewable Energy World: Konrad believes that 2014 will be a great year for renewable energy finance, he said. He said that we saw the beginning of it in 2013 with the securitization of a bond by Solar City (SCTY) and pointed to Hannon Armstrong’s (HASI) securitization of an energy efficiency bond in late December 2013 as another indicator that renewable energy...

What Yieldco Managers Are Saying About The Market Meltdown

by Tom Konrad Ph.D., CFA Note: This article was first published on GreenTechMedia on Noveber 27th. In the last six months, YieldCos have fallen from stock market darlings to pariahs. YieldCos are companies that buy clean energy projects such as solar and wind farms, and use the majority of free cash flow from these projects to pay dividends to investors. Many are listed subsidiaries or carve-outs of large developers of clean energy projects. Last year, investors repeatedly punished leading solar developers and manufacturer First Solar and SunPower for their reluctance to launch YieldCos. When...

Trina Solar’s Second Convertible Bond

By Beate Sonerud and Sean Kidney China’s Trina Solar (TSL)is issuing US$100m of convertible bonds with 5-year tenor and 4% annual coupon, with semi-annual payments. An extra US$15m could be raised, as Trina has given the underwriters a 1-month window to buy additional bonds. Guess they are waiting to gauge demand. Underwriters are Deutsche Bank, Barclays, and Credit Suisse, with Roth Capital Partners as co-manager. The bonds can be converted to shares (American Depositary Shares, meaning they are listed in the US) at an initial price of US$14.69 per share. Currently, Trina’s shares are trading at US$11.40, after...

Wall Street Banks Promote New Green Bonds Framework

by Sean Kidney Earlier this month CitiBank (NYSE:C) and Bank of America Merrill Lynch (BoAML; NYSE:BAC) launched, via a special EuroWeek report on ‘sustainable’ capital markets, a “Framework for Green Bonds“. This is potentially a big development. In the paper the two banks laid out a ‘vision’ for the green bonds market and called for a Green Bonds Working Group of issuers, dealers and investors to be formed to drive the evolution of the nascent market. The paper calls for debate about the green bond market, especially about...

How Much Could Another Yieldco Pay For 8point3?

by Tom Konrad Ph.D., CFA

When SunPower (SPWR) and First Solar's (FSLR) YieldCo, 8point3 Energy Partners (CAFD), went public two years ago, I used the financial nerd joke in 8point3's ticker symbol as a launching point to explain what "cash available for distribution," or CAFD, means.

In that article, I cautioned against the risks of using a short-term cash flow measure for long-term investing decisions. That risk is becoming more and more real for investors in 8point3 because the YieldCo is using short-term, interest-only financing to fund its long-term investments.

All of 8point3's debt matures in 2020, and refinancing that debt will...

Developments in the Solar Corporate Bond Market

by Corporate Bonder The global bond market is huge. Data from the Bank for International Settlements shows that the total size of the global debt securities market (domestic and international securities) was $99.5 trillion as at June 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $43.7 trillion of outstanding debt securities, financial organizations $43.8 trillion, corporations $11.0 trillion and international organizations $1.0 trillion. Against that, Bloomberg has estimated that there are $230bn outstanding of fixed-interest securities that meet their “green bonds” definition. And of course the IEA talks of $1 trillion of investment a...

Terraform Power Issues $800m High Yield Green Bond

by the Climate Bonds Team This week the yieldco TerraForm Power (TERP) issued a huge high-yield green bond; seeing more high-yield bonds is a sign that the green bond market is continuing to mature. In addition to TerraForm, more green bonds from repeat issuers OPIC, World Bank, IFC and Credit Agricole have been announced and will be closing in the coming weeks. For today, let’s dig deeper into the latest green high-yield offering. The US-based renewable energy company TerraForm Power Operating has issued US$800m of senior unsecured green bonds (debentures), making it the largest green bond of 2015...

The Greenium: Growing Evidence of a Green Bond Premium

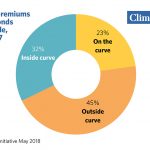

Highlights from the latest Q4 2017 Green Bond Report from the Climate Bonds Initiative: Two years of data observations examining green bond behavior in primary markets

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually allowing a more longtitudinal analysis as the market expands.

The Q4 2017 report covers USD15.1bn or almost 40% of the face value of labelled green bonds issued in Q4. 15 EUR and 8 USD labelled green bonds are...

The Pros Pick Three Green Income Stocks For 2014

It’s now possible to invest in green stocks for income, not just for growth. Here are three picks for 2014 from green investing professionals.

A Flurry Of Green Muni Bonds

by Tess Olsen-Rong Green municipal bonds are set to take off in 2015 after a flurry of issuances in the latter half of 2014. With interest rates at an all time low, this is the time to finance the vast backlog of infrastructure upgrades and developments needed – and to green that infrastructure. This, according to the Financial Times, is especially so in the US. With green muni growth has come a growing diversity in the use of proceeds. Some green municipal bonds are using proceeds for projects where the green credentials are more complex to analyse...

Convertible Solar Bonds: Trina, SunPower Stoke Fire; Ascent Descends

by Sean Kidney Trina’s $150m 3.5% 5yr convertible solar bond In June Chinese solar manufacturer Trina announced the private placement of $150m of 5 year, 3.5% convertible bonds to “institutional investors” (no details provided). Trina weren’t clear how they would use the proceeds, but they are planning to build 400-500MW of solar plants over the rest of this year. Book-runners were Deutsche Bank, Barclays, J.P. Morgan and Goldman Sachs (Asia), with co-manager HSBC. SunPower issues $400m 7yr 0.875% (!) convertible solar bond That same month SunPower announced a private placement of $400 million, 7 year, 0.875% senior convertible bonds. What...