A Flurry Of Green Muni Bonds

by Tess Olsen-Rong Green municipal bonds are set to take off in 2015 after a flurry of issuances in the latter half of 2014. With interest rates at an all time low, this is the time to finance the vast backlog of infrastructure upgrades and developments needed – and to green that infrastructure. This, according to the Financial Times, is especially so in the US. With green muni growth has come a growing diversity in the use of proceeds. Some green municipal bonds are using proceeds for projects where the green credentials are more complex to analyse...

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

Lots of new issuers

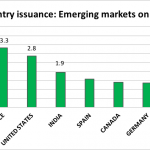

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Enviva: Wood Pellets Into Dividends

by Debra Fiakas CFA Last week Enviva Partners, LP (EVA: NYSE) reported financial performance for its wood pellets business in its quarter ending September 2015. Sales totaled a whopping $116.6 million, representing a 53% increase compared to $40.5 million in the same quarter last year. The big jump in revenue resulted from higher volumes to larger customers. Distributable cash flow totaled $12.6 million compared to $8.2 million in the year ago period. Quarter performance made possible a declared cash distribution of $0.44 per common unit, which is 7% higher than the minimum quarterly distribution. At its...

Trash Stocks Trashed: An Income Opportunity?

Tom Konrad CFA Dumpster diving for high yielding gems. An earlier version of this article was written at the end of July and published on my Forbes blog, before the August market implosion. I've updated it here to reflect the new stock prices and some recent company news. Renewable energy has many advantages over fossil energy. One of the most important is that it's renewable. As supplies of Oil and other fossil fuels are used up, they become harder and more expensive to extract, while renewable energy is generally getting cheaper over time,...

Buffet Bet Comes Out for Solar

by Sean Kidney Warren Buffet is a famous proponent of value investing and he surely received a sign of the value in solar investments over fossil fuels last week. The MidAmerican Energy $850m Topaz solar project bond we mentioned a couple of weeks ago was so successful that a second tranche is expected to cover the remaining debt of the project. The offer was oversubscribed by $400m which would have mopped up the total $1.2bn of debt in the project; Buffet's Berkshire Hathaway (BRK-A) controls MidAmerican. In contrast, Buffet’s investment in $2bn of bonds from gas company...

Solar Bonds For Small Investors

By Beate Sonerud SolarCity (NASD:SCTY) is issuing US$200m of asset-linked retail bonds, with maturities ranging from 1-7 years and interest rates from 2-4%. Wells Fargo is the banking partner. While the bonds are registered,SolarCity expects the bonds to be buy and hold, and not traded in the secondary markets. The bond is issued for small-scale investors, with investment starting at US$1000, giving this bond issuance a crowdfunding aspect. Choosing such a different structure allows SolarCity to diversify their investor base – the company stresses that small-scale investors are a complement, not substitute, for large-scale institutional investors. While...

First Solar and SunPower Lobby Shareholders to Sell 8point3 YieldCo

by Tom Konrad Ph.D., CFA

Will shareholders accept the deal?

On Monday, 8point3 Energy Partners, the joint YieldCo from First Solar and SunPower, entered into a definitive agreement to be acquired by Capital Dynamics.

When public companies are sold, it's almost always at a premium to the market price. It's that price premium that persuades shareholders to sell. So why would 8point3 (NASD: CAFD) shareholders accept a deal that offers them only $12.35, or 15 to 20 percent below the roughly $15 price CAFD has been trading around for the past three months?

To answer this question, we need a little history.

Jan Schalkwijk, founder...

Why This German Solar Executive Is Skeptical About American YieldCo Assumptions

by Tom Konrad CFA Ever since the first YieldCo, NRG Yield (NYSE:NYLD), went public in 2013, it and other similar YieldCos have been reshaping the market for operating renewable energy assets, especially wind and solar PV farms. A YieldCo is, to put it simply, a publicly traded subsidiary of a developer and operator of clean energy farms that uses the cash flow from its assets to return a high current dividend to shareholders. Most large, publicly traded clean energy developers have already launched or are preparing to launch a YieldCo. The current crop includes NRG Yield, Pattern...

Comparing Community Solar Subscriptions And Yieldcos

By Tom Konrad, Ph.D. CFA Community solar is gaining traction in many states. The concept, also known as shared solar or solar gardens, originated in the mid-2000s as a way to allow broader participation in the ownership of solar photovoltaic (PV) systems, while also encouraging local development. Community solar broadens access to solar beyond homeowners with suitable roofs. A National Renewable Energy Laboratory report from 2015 estimated that 49 percent of households cannot own solar because they do not own their own home, or they live in high-rise buildings with insufficient roof space. Rooftop solar is impractical for many...

Covanta and Hannon Armstrong Earnings

by Tom Konrad, Ph.D. CFA

Two more earnings notes I shared with my Patreon followers on February 18th.

Covanta Holdings (CVA)

Leading waste-to-energy firm Covanta Holdings (CVA) announced 2020 earnings today. There will be a conference call tomorrow morning, but here is my high-level impression:

The company managed well through Covid and ended the year within it's original pre-covid guidance. Metals and energy prices, as well as increased maintenance capital expenditures were a drag on results, but prices are improving and capital expenditures will fall in 2021.

The company is conducting a strategic review which will likely result in the sale of some underperforming...

No Longer Just Growth: Investing in Renewable Energies for Yield

by Robert Muir Given the determined investor quest for yield as the Federal Reserve maintains the benchmark Federal Funds rate at zero, and the resurgence of attention being paid to alternative energy generation, mainly solar, and to a lesser extent wind and hydro, it’s no wonder Yield Co’s have gained so much investor interest lately. In the near to mid-term, the enthusiasm may be justified. Supported by Power Purchase Agreements, energy infrastructure financing and leasing contracts, and electricity transmission and distribution concessions, all with credit-worthy counter-parties, Yield Co’s are designed specifically to pay out a large portion of...

Fifteen Clean Energy Yield Cos: Company Structure

Tom Konrad CFA In the first article of this survey of yield cos, I looked at the possible reasons for the seemingly endless enthusiasm for US-listed clean energy yield cos. Here, I'll take a look at how these yield cos are constructed, and why investors should prefer one structure over another. Who's Your Daddy? Most yield cos have been created by clean energy project developers in order to create a ready, low-cost buyer for those projects. With the recent string of very successful IPOs, the capital available for such projects may prove...

Fifteen Clean Energy Yield Cos, Created Unequal

Tom Konrad CFA Renewable Energy Investing Grows Up. In January I predicted 2014 would be the year "renewable energy finance comes of age." Here's how Jennifer Runyon quoted me on Renewable Energy World: Konrad believes that 2014 will be a great year for renewable energy finance, he said. He said that we saw the beginning of it in 2013 with the securitization of a bond by Solar City (SCTY) and pointed to Hannon Armstrong’s (HASI) securitization of an energy efficiency bond in late December 2013 as another indicator that renewable energy...

A Clean Energy REIT: Hannon Armstrong Sustainable Infrastructure

Tom Konrad CFA On April 18th, Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI) IPOed on the New York Stock Exchange. HASI is one of only two publicly traded Real Estate Investment Trusts (REITs) dedicated to sustainable infrastructure. The other such sustainable REIT is Power REIT (NYSE:PW), which I have written about extensively. PW is both illiquid and involved in significant litigation, two factors which may put off the conservative investors who gravitate towards REITs. In December, Power REIT purchased the land...

Green swan, Black swan: No matter as long as it reduces stranded spending

by Prashant Vaze, The Climate bonds Initiative

In January, authors from several institutions under the aegis of BiS, published The Green Swan Central banking and financial stability in the age of climate change setting out their take on the epistemological foundations for, and obstacles against, central banks acting to mitigate climate change risk.

The book’s early chapters provide a cogent and up-to-date analysis of climate change’s profound and irreversible impacts on ecosystems and society. The authors are critical of overly simplistic solutions such as relying on just carbon taxes. They also recognize the all-too-evident deficits in global policy to respond to the threat.

In short, they accept the need for central banks to act.

The Two Arguments

The paper makes two powerful arguments setting out the challenges central banks face using their usual mode of working.

Firstly, climate change’s impact on financial systems is an unknowable unknown – a...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...