Unlocking Solar Energy’s Value as an Asset Class

by James Montgomery

2014 is predicted to be a breakout year for solar financing, as the industry eagerly pursues finance innovations. Many of these methods aren't really new to other industries, but they are potentially game-changing when applied in the solar industry.

Solar Rooftop Lease Securitization A Ground-Breaking Success

Sean Kidney Last week we blogged that SolarCity (SCTY) and Credit Suisse were about to issue a new $54.4 million, climate bond – a rooftop solar lease securitization. It’s out: BBB+, 4.8%, 13 years. The long tenor is interesting – and great. And S&P’s BBB+ rating suggest those credit analysts may be beginning to understand solar. This bond has been long-awaited by the green finance sector, who are hoping it’s the harbinger of things to come. I did get the chance to look at the S&P opinion. Their rating reflected, as they put it, their views on over-collateralization (62%...

Fifteen Clean Energy Yield Cos, Created Unequal

Tom Konrad CFA Renewable Energy Investing Grows Up. In January I predicted 2014 would be the year "renewable energy finance comes of age." Here's how Jennifer Runyon quoted me on Renewable Energy World: Konrad believes that 2014 will be a great year for renewable energy finance, he said. He said that we saw the beginning of it in 2013 with the securitization of a bond by Solar City (SCTY) and pointed to Hannon Armstrong’s (HASI) securitization of an energy efficiency bond in late December 2013 as another indicator that renewable energy...

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

Lots of new issuers

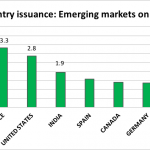

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Why This German Solar Executive Is Skeptical About American YieldCo Assumptions

by Tom Konrad CFA Ever since the first YieldCo, NRG Yield (NYSE:NYLD), went public in 2013, it and other similar YieldCos have been reshaping the market for operating renewable energy assets, especially wind and solar PV farms. A YieldCo is, to put it simply, a publicly traded subsidiary of a developer and operator of clean energy farms that uses the cash flow from its assets to return a high current dividend to shareholders. Most large, publicly traded clean energy developers have already launched or are preparing to launch a YieldCo. The current crop includes NRG Yield, Pattern...

Green Bond Market Heats Up After Slow Start To 2015

$7.2 billion of green bonds issued. Market shows signs of maturity, including more currencies, and non-investment grade bonds. Emerging market green bonds are ramping up, while green munis are booming. by Tess Olsen-Rong, Climate Bonds Market Analyst The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the...

Investors Expect Rapid Growth At Pattern Energy Group

Tom Konrad CFA Pattern Energy's Gulf Wind Farm in Armstrong, Texas Disclosure: Long BEP. Pattern Energy Group (NASD:PEGI, TSX:PEG) completed a very successful Initial Public Offering (IPO) on the Nasdaq and Toronto stock exchanges on September 27th. Not only did the shares price at $22, near the top of the expected range, but the underwriters exercised their full over allotment option to purchase 2.4 million shares in addition to the initial 16 million offered. Total proceeds from the offering were $404.8 million. Most of the proceeds went to Pattern Energy Group, LP (PEGLP) in consideration for a...

New Green Bonds From Terraform And Goldwind

by the Climate Bonds Team Second green bond from TerraForm to finance wind power acquisition, $300m 10yr, 6.125% s/a coupon, BB-/B1 TerraForm Power Operating , the yieldco spin off from SunEdison , has issued a second green bond shortly after tapping its inaugural green bond for a further $150m (making their first green bond a whopping $950m!). The new $300m green bond has 10-year tenor and semi-annual coupon of 6.125%, and was issued in the US private placement market. It is sub-investment grade with a rating of BB- from S&P and B1...

Are YieldCos Overpaying for Their Assets?

Tom Konrad CFA YieldCos buy and own clean energy projects with the intent of using the resulting cash flows to pay a high dividend to their investors. Several such companies, often captive subsidiaries of listed project developers, have listed on U.S. markets since 2013. So far, YieldCos have been a win-win: The developers that list YieldCos have gained access to inexpensive capital, and income investors have gotten access to a new asset class paying stable and growing dividends. So far, they have also gained from significant stock price appreciation. The seven U.S.-listed YieldCos are up...

Investors Awaken to NextEra YieldCo

by Debra Fiakas CFA Last week NextEra Energy Partners, LP (NEP: NYSE) reported financial results for the third quarter ending September 2015. The numbers were released in along with quarter results from its parent, Florida-based utility NextEra Energy, Inc. (NEE: NYSE). The partnership is the operating arm of clean energy projects originated by the NextEra parent. The ‘yieldco’ as these operating entities have been kindly dubbed by shareholders, delivered $1.0 million in reported net income, but operating cash flow was a whopping $36 million in the quarter. The consensus estimate had been for $0.24 in earnings per...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

Five Green Dividend Stocks to Watch

Tom Konrad CFA The Perfect Stock My ideal stock is: Green (in that the company is helping to make the economy more sustainable) Pays a good dividend (in the current low-interest rate environment, I consider 4% to be “good”) Has earnings and free cash flow large enough to easily sustain the dividend, and Has low debt, leading to low earnings and cash flow volatility. I like such stocks because I can buy them, and pretty much ignore them. This leaves me time to research more speculative green stocks, while still knowing that much of my portfolio is producing...

Terraform Power Issues $800m High Yield Green Bond

by the Climate Bonds Team This week the yieldco TerraForm Power (TERP) issued a huge high-yield green bond; seeing more high-yield bonds is a sign that the green bond market is continuing to mature. In addition to TerraForm, more green bonds from repeat issuers OPIC, World Bank, IFC and Credit Agricole have been announced and will be closing in the coming weeks. For today, let’s dig deeper into the latest green high-yield offering. The US-based renewable energy company TerraForm Power Operating has issued US$800m of senior unsecured green bonds (debentures), making it the largest green bond of 2015...

Developments in the Solar Corporate Bond Market

by Corporate Bonder The global bond market is huge. Data from the Bank for International Settlements shows that the total size of the global debt securities market (domestic and international securities) was $99.5 trillion as at June 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $43.7 trillion of outstanding debt securities, financial organizations $43.8 trillion, corporations $11.0 trillion and international organizations $1.0 trillion. Against that, Bloomberg has estimated that there are $230bn outstanding of fixed-interest securities that meet their “green bonds” definition. And of course the IEA talks of $1 trillion of investment a...

The Status of The Yieldco

by Tom Konrad, Ph.D., CFA Last week I delivered the keynote at Yieldcon USA, a conference put on by Solar Plaza entirely focused on Yieldcos. (Yieldcos are companies that own clean energy assets such as solar and wind farms and use the cash flows to pay a high rate of current income to investors.) Given all that's gone on in the space in the last few weeks, the conference could not have been more timely. You can find the presentation here and embedded below:

Wall Street Banks Promote New Green Bonds Framework

by Sean Kidney Earlier this month CitiBank (NYSE:C) and Bank of America Merrill Lynch (BoAML; NYSE:BAC) launched, via a special EuroWeek report on ‘sustainable’ capital markets, a “Framework for Green Bonds“. This is potentially a big development. In the paper the two banks laid out a ‘vision’ for the green bonds market and called for a Green Bonds Working Group of issuers, dealers and investors to be formed to drive the evolution of the nascent market. The paper calls for debate about the green bond market, especially about...