List of Clean Energy and Alternative Energy Mutual Funds

Alternative energy and clean energy mutual funds are open-ended funds that invest primarily (at least 50% of the portfolio) in the securities of clean energy and alternative energy companies. Closed-end funds are included in the list of alternative energy and clean energy ETFs.

This list was last updated on 2/20/2021.

Allianz RCM Global EcoTrendsSM Fund (ADGLECO.TT)

Calvert Global Energy Solutions Fund Class A (CGAEX); Class C (CGACX)

Calvert Green Bond Fund (CGAFX)

Ecofin Global Renewables Infrastructure Fund (ECOIX)

Erste WWF Stock Environment CZK (AT0000A044X2.VI)

Eventide Multi-Asset Income (ETNMX)

Fidelity Select Environment and Alternative Energy Portfolio (FSLEX)

Firsthand Alternative Energy (ALTEX)

Gabelli ESG Fund Class AAA (SRIGX); class C (SRICX)

Guinness Atkinson Alternative Energy...

List of Alternative Energy and Clean Energy ETFs

This list was last updated on 4/27/2022.

ETFs are Exchange-listed funds which pool investor's money for the purpose of making Alternative Energy investments. Exchange Traded Funds (ETFs) track a specified Alternative Energy index. This list also includes closed-end mutual funds and other pooled investments which trade on exchanges.

ALPS Clean Energy ETF (ACES)

ASN Groenprojectenfonds (ASNGF.AS)

Bluefield Solar Income Fund (BSIF.L)

Defiance Next Gen H2 ETF (HDRO)

Evolve Funds Automobile Innovation Index ETF (CARS.TO)

First Trust Global Wind Energy Index (FAN)

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Foresight Solar Fund Limited (FSFL.L)

Global X Lithium...

Are Aspiration’s Deposits Really Fossil Fuel Free?

Fossil Fuel Free Claims

If you are reading this, you've probably also seen advertisements for Aspriation's “Fee-free and fossil fuel free” banking services. Like the advertisements the company's product page encourages visitors to “Earn high interest on what you save with an account that is fee-free and fossil fuel free.“

As a professional green money manager, I know that “fossil fuel free” is in the eye of the beholder. For many mutual funds, “fossil fuel free” simply means avoiding the 200 largest fossil fuel companies, but investing in the 201st largest fossil fuel company, even if its primary business is mining...

529 Plans Without The Fossil Fuels

by Tom Konrad Ph.D., CFA

The most popular way we have to save for our children's future education is destroying their future.

A 529 savings plan is a tax-advantaged savings plan designed to help pay for education. There are also prepaid tuition plans set up under the section 529 tax rules, but this article is focused on 529 savings plans, and will be what I mean by “529 plans” for the rest of the article.

The money in 529 plans can be used for college as well as K-12 education, apprenticeship programs, and paying off some student debt. Savings plans grow...

Step By Step Fossil Fuel Divesting With Mutual Funds

by Tom Konrad Ph.D., CFA

A large and growing number of individual investors are showing an interest in divesting from fossil fuels. Where in the past I have been asked to give a talk on divestment once every year or two, I’ve spoken on the subject three times so far in 2020. (Here is a recording of a presentation I did for my college alumni association.)

The response to these talks has been overwhelmingly positive, but I’m left with the impression that a lot of the less financially sophisticated attendees are still not sure where to start. For most of these...

Updates to Clean Energy Mutual Fund and ETF Lists

Thanks an email from a diligent reader, I have just updated our lists of Clean and Alternative Energy Mutual Funds and Clean and Alternative ETFs and Other Exchange Traded Funds. Please follow the links to the updated lists.

Thanks to him and all the readers who help me keep AltEnergyStocks.com stock lists up to date with your comments and emails.

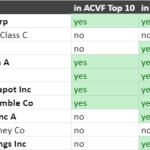

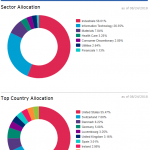

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

Index Funds Are Climate Change Denial

Garvin Jabusch You probably know that index funds have become all the rage in investing over the past several years, as investors flock to their low fees and reject the gospel of active management. But you probably don’t know that investing in a broad-based index fund not only ignores rapid changes in the energy economy but also makes the investor complicit in climate change denial. And just as climate denial ignores the inherent risks of fossil fuels to environment, economy, and society, “set it and forget it” index investing ignores the inherent risks of fossil fuels and related stocks...

Fuel Cell Companies Purchased for Portfolio

I placed several trades for the mutual fund this afternoon to start building a position in some of the fuel cell companies. This sub-sector has been under pressure the last couple of months but seems to be building a nice base of support at the current levels. I feel this entire sub-sector is ready for a nice up move and the stocks have been behaving nicely the last week or so. The one stock I seriously considered not adding was Quantum. The stock has been in a steady decline and there is no sign that it’s going to slow...

ESG5 Summit brief

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are...

New Wind ETF FAN Cools Off Sunburned Portfolios

Update:You can find a comparison of FAN with PWND. a more recent wind ETF here. Since I last covered clean energy mutual funds and ETFs, the sector has seen the launch of two solar ETFs (KWT the Market Vectors Solar Energy ETF from VanEck, and TAN, the Claymore/MAC Global Solar Energy ETF.) Continuing in the tradition of cute ticker symbols, First Trust's new global wind energy ETF is FAN. I recommend that investors stay away from the (very expensive) green energy mutual funds, and invest either in one of the ETFs, or if they have...

The Best Clean and Renewable Energy ETFs

Tom Konrad CFA For short term holders, the Powershares Wilderhill Clean Energy ETF (PBW) is the best If cost is the most important factor, an individual investor without the time or expertise to build a clean energy stock portfolio should choose one of the clean energy Exchange Traded Funds (ETFs). I recently reversed my former stance, and now believe that cost should not be the only factor, because the evidence suggests that, in clean energy at least, the active management available from a mutual fund or an advisor who works with individual stocks can...

Renewable and Alternative Energy Mutual Funds Compared

If you can, you are better off in one of the clean energy ETFs, or even a portfolio of individual clean energy stocks (here are 10 clean energy picks for 2009.) However, it you want a mutual fund for the ease of investment, or you are looking to add one to a retirement plan, the Winslow Green Growth Fund comes out on top because of its emphasis on energy efficiency stocks (including these two Geothermal Heat Pump stocks), and its lower expenses.

How Green Is Your Mutual Fund?

By Harris Roen Not all alternative energy mutual funds are created equal. In a recent interview with the Wall Street Journal, a reporter asked me which alternative energy mutual funds were the most focused on renewables, noting that many mutual funds hold non-energy related companies such as Apple, PepsiCo and Google. The answer to this question is not as straight forward as one might think. This article sorts out which mutual funds are truly invested in the dynamic and growing green energy sector, and which ones are more peripheral. Greener Than Thou–Revealing How Much...

Choosing The Right Clean Energy Mutual Fund or ETF

Tom Konrad CFA If you want to invest in renewable energy and energy efficiency with just one fund, this is what you need to know. Over the last few months, I've written an extended series of articles looking at clean energy mutual funds and clean energy exchange traded funds (ETFs). Defining Clean Energy For my purposes, a clean energy fund is one that primarily invests in companies involved in renewable energy, energy efficiency and conservation, efficient and alternative fuel vehicles, and companies that are part of the supply chain for any of the above...