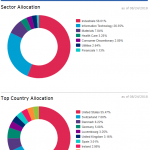

Is the New Smart Grid ETF GRID All That Smart?

Tom Konrad, CFA First Trust Launched a Grid Infrastructure Exchange Traded Fund (ETF) on November 17th. Although the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (Nasdaq: GRID) is labeled a "Smart Grid" ETF to capture popular excitement around smart grid technology, it covers the whole grid infrastructure sector. This broader focus is good for clean energy investors. I've been an advocate of investing in electric transmission and smart gird stocks since early 2007, and for almost a year now, a regular reader has been telling me to create a transmission ETF so he can buy...

Should “Green” Funds Invest in Fossil Fuels?

Marc Gunther Bill McKibben’s groundbreaking Rolling Stone story (Global Warming’s Terrifying New Math) and 350.org’s “Do the Math” divestment campaign raise important and difficult questions about fossil fuels. One that is starting to roil the world of socially-responsibly investing is this: How should mutual funds that strive to be “green” or “sustainable” or “socially responsible” deal with the fossil fuel companies in their portfolios? Should they divest, as McKibben argues? That was the topic of a column I wrote last week for the Guardian Sustainable Business, which generated some noteworthy responses. It’s part of the British newspaper...

Alternative Energy Funds: 2014 Review

By Harris Roen Mutual Funds (MFs) Falling fossil fuel prices have hampered 2014 returns for alternative energy mutual funds. Returns are slightly down on average for the past three-month, with a third of funds showing losses. Monthly gains fared worse, with only 2 out of 14 funds in the black. One-year returns are flat on average, and range from a high of 8.3% for Gabelli SRI Green AAA (SRIGX), to a low of -14.3% for Guinness Atkinson Alternative Energy (GAAEX)… Exchange Traded Funds (ETFs) Alternative energy ETFs had a wide range of returns for 2014,...

If a Clean Energy Mutual Fund Falls in the Forest…

When I was researching my Comparison of Clean Energy Mutual Funds and Clean Energy Tracking Portfolio articles, I came across something strange: the American Trust Energy Alternatives Fund (ATEAX) did not seem to have a listing on American Trust's website. However, finance sites were still publishing price and holdings data, and there was no recent news, so I didn't think much of it, since other funds seemed superior based on both costs and fund holdings. Last week, I noticed that the fund's price had not changed since the end of February, so I did a little digging. Here is...

Investing In Renewable Energy 101

UPDATE 3/4/2011: An up-to date article on selecting green mutual funds and ETFs can be found here. Why Invest in Renewable Energy? Given all the attention that renewable energy is getting in the news over the last couple years, investing in renewable energy has become a hot topic. People are drawn to renewable energy for one of several reasons: To fight Global Warming To prepare for Peak Oil. To improve Energy Security and local economies. To cash in on the above trends. The beauty of investing in renewable energy companies is that these goals are not...

Sharp Drops for Alternative Energy Mutual Funds and ETFs

By Harris Roen Alternative Energy Mutual Funds Down for the Quarter, Mixed for the Year Alternative energy mutual funds have turned sharply lower over the past three months. Of the 14 MFs that the Roen Financial Report tracks, all but one are down for the quarter. Five are posting double-digit declines. On average, the drop in MFs are similar to that of the S&P 500 and Down Jones Industrial Average, which fell 7.44% and 9.6% respectively. The only MF showing a gain… ETFs are Widely Lower Green ETFs are showing poor returns on both a...

Renewable Energy and Cleantech Mutual Funds and ETFs: Does Tax Efficiency Matter?

Alternative Energy and Climate Change Mutual Funds, Part VI Tom Konrad CFA My recent article, In Clean Energy, Active Management Pays, started a bit of a controversy. Rafael Coven, the Index Manager for The Cleantech Index (^CTIUS), which is the index behind the Powershares Cleantech Portfolio (PZD), left a comment on Barrons and sent me an email saying, "Your comparison of funds and ETFs ignores the tax efficiency differences which are very significant." Rafael is right that it's important for many investors to consider taxes before making an investment decision, and that ETFs are often more...

Crude Oil & Alt Energy: The Non-Relationship That Just Won’t Go Away

Charles Morand The relationship - or lack thereof - between oil prices and the performance of alt energy stocks has been a long-time interest of mine. I discussed it last in late March when I looked at correlations between the daily returns of alt energy and fossil energy ETFs. At the time, I found that only a weak relationship existed between the two and that if someone wanted to make a thematic investment play on Peak Oil, alt energy ETFs were not an ideal way to do so. Seeing as the popular press and countless "experts"...

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

529 Plans Without The Fossil Fuels

by Tom Konrad Ph.D., CFA

The most popular way we have to save for our children's future education is destroying their future.

A 529 savings plan is a tax-advantaged savings plan designed to help pay for education. There are also prepaid tuition plans set up under the section 529 tax rules, but this article is focused on 529 savings plans, and will be what I mean by “529 plans” for the rest of the article.

The money in 529 plans can be used for college as well as K-12 education, apprenticeship programs, and paying off some student debt. Savings plans grow...

Solar Stocks As the Best Play On The Cleantech Revolution? (Part II)

A couple of weeks ago, I wrote about a recent report claiming that solar PV was going to be at the fore of the "cleantech revolution." I've never doubted solar PV's potential. What I like most about it, besides the fact that it's the most abundant energy form on Earth, is the ability for solar technologies to be deployed either through the building stock as a load-abatement measure or in large arrays of panels as solar parks. No other power generation technology can be scaled simultaneously through these two routes. Besides investments in Energy Conversion Devices (ENER)...

The Very Quick Guide To A Green Portfolio

Tom Konrad CFA For many, the decision to get out of fossil fuels is an easy one. It may be because it's the right thing to do, or because we see the risks of investing in businesses built around an unsustainable economic paradigm. This article is not about that decision; it's about what to do next. The Green Portfolio: What And Why To a lesser extent, it also depends on what we mean when we say "green." For simplicity, this article will focus on making your portfolio Fossil Fuel Free (FFF), meaning that the portfolio should...

Can Alternative Energy Mutual Funds and ETFs Continue to Beat the Market?

By Harris Roen Alternative Energy Mutual Fund Returns Alternative energy mutual funds have proven to be an excellent investment over the past year or more, but those gains have flattened out as of late. MFs are up 33% on average with even the lowest returning fund, Gabelli SRI Green AAA (SRIGX), up 15% for the year. The alternative energy sector is by far beating the overall market. For comparison, as of April 21 the tech heavy NASDAQ was up around 27% for 12 months, the S&P 500 by 20%, and the Dow Jones Industrial Average...

Index Funds Are Climate Change Denial

Garvin Jabusch You probably know that index funds have become all the rage in investing over the past several years, as investors flock to their low fees and reject the gospel of active management. But you probably don’t know that investing in a broad-based index fund not only ignores rapid changes in the energy economy but also makes the investor complicit in climate change denial. And just as climate denial ignores the inherent risks of fossil fuels to environment, economy, and society, “set it and forget it” index investing ignores the inherent risks of fossil fuels and related stocks...

Do Falling Alternative Energy Funds Returns Signal Danger?

By Harris Roen Green Mutual Fund Returns Falter Returns for green mutual funds have slid as of late. Longer term, however, alternative energy MFs are still showing strong gains. All MFs are in positive territory for the past 12 months, and 6 out of 14 funds are up double digits. Three year returns have faired even better, showing an annualized return of 14.3% on average. Short term, however, almost all the funds have given up a significant amount of their recent gains. For example, Firsthand Alternative Energy (ALTEX), the MF with the best one-year returns, gave up...

The Holdings of the Powershares Global Progressive Transport Portfolio ETF (PTRP)

Tom Konrad, CFA I included the Powershares Global Progressive Transport Portfolio (PTRP) as an investment option instead of three stocks in my Ten Clean Energy Stocks for 2010, as part of a simplified portfolio for small investors wanting to minimize costs by making fewer trades. The other Exchange Traded Fund I used in this way was the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID). I took a look at the holdings of the Smart Grid ETF here, and they are not exactly what you would expect from the name. Since it makes sense to know...