by Debra Fiakas CFA

Last week management of Electrovaya Inc. (EFL: TSX; EFLVF: OTC/QB) were forced to issue a statement stating there were no fundamental developments to explain a dramatic decline in its share price. The stock was trimmed back by 30% in two days under exceptional trading volume. Electrovaya has developed proprietary lithium ion polymer batteries for grid storage and transportation applications. Other than financial results for the quarter ending March 2017, the Company has had little to tell investors about the batteries, its customers or any other topic.

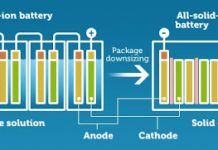

Electrovaya distinguishes its lithium ion batteries among competitors with a ceramic separator that improves battery safety. Zero hazardous accidents have been reported for the batteries with this innovation used in smart cars. Competitors have reported battery failures some of which have resulted in car fires. Inadequate insulation of electrodes is often cited as a reason for such ‘thermal runaway’ in batteries.

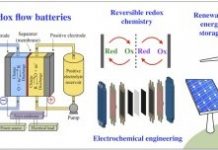

The company’s business pipeline appears to be gaining volume. During the last earnings conference call management reported new orders in the materials handling sector. Additionally, one of its battery modules in being tested for residential energy storage applications in the U.S., Europe and Asia.

Management has characterized the year 2017 as a transition year for Electrovaya. The company reported CDN$19.5 million in total sales in the fiscal year ending September 2016. At this level of production, gross profit was 25% of sale and not large enough to cover operating costs. Nonetheless, greater efficiency is expected as the company increases utilization of new production capacity recently acquired in Germany.

The company used CDN$8.1 million in cash to support operations in the 2016 fiscal year. Cash resources were dangerously depleted at the end of September 2016, at CDN$668,000. A new loan of $17 million has fortified the coffers. We estimate the company has sufficient resources to support operations for at least another year, longer if the pace of business picks up. An expansion in order volume could lead to greater production efficiency is and higher gross margin.

For investors with confidence in Electrovaya management to deliver on its strategic plan, the dramatic decline in price represents a compelling opportunity to pick up shares at a bargain price. The company recently appointed a new director of sales for the U.S. materials handling market. The plan is to build on recent new relationship with a Fortune 100 company with a fleet of forklifts.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.