by Debra Fiakas, CFA

Last week management of energy storage developer BioSolar, Inc. (BSRC: OTC/PK) provided an update on the company lithium-ion battery design. The company’s engineers along with a manufacturing partner are still making changes to the design called the 21700 cell. Additionally, the company recently decided to take greater control over raw materials supply, potentially sourcing and processing materials in the U.S.

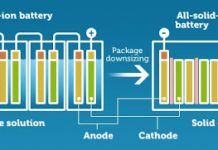

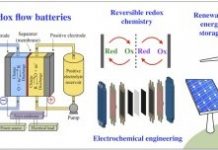

Engineers at BioSolar have been trying to increase the storage capacity of lithium-ion batteries by improving the anode component. The plan is to sell ‘super anodes’ to battery manufacturers to make existing lithium-ion batteries work like super batteries. Prototypes were tested in July 2019, to build a database of performance metrics that will guide the next round of design adjustments.

The BioSolar anode relies on silicon additives to boost energy and power performance. Indeed, silicon anodes are thought to potentially have a capacity as much as 4,200 milliamp hours per gram (mAh/g), which provides a measure of the amount of charge or electronics per gram of anode material. This compares to the most commonplace anode made from graphite with a capacity of 350 mAh/g.

That tenfold increase in power has some battery manufacturers salivating despite the many negatives associated with silicon anodes. First, silicon is an expensive material. Additionally, silicon does not behave well as the battery is charged and then discharges, expanding by as much as 300% in volume. This can cause the silicon to crack and trap lithium electrolyte in the silicon material.

BioSolar engineers think they have some know-how that could overcome silicon’s worst failings. They have designed silicon-alloy materials that could have a capacity of 1,500 mAh/g. Incorporated in a battery of the sort used by Tesla for its all-electric cars, the resulting battery could have a volumetric energy density of 1,000 weight per liter or Wh/L. This compares to a volumetric energy density of 676 Wh/L for the battery currently used in the Tesla Model S.

It will be a great anode if BioSolar is successful. No doubt Tesla would be first in line to buy a few. Nonetheless, the company has a more modest commercial target in batteries for power tools, which is nearly as large a market as vehicle batteries. Those performance numbers are still goals for BioSolar and not yet accomplishments. There is still considerable work to be done to bring a silicon anode to the commercial market.

For investors the BioSolar story can be a bit confusing. While the company has been prolific over the last year in releasing updates and memos on its progress in developing energy storage technology, the annual report published in March 2019, still chatters on about solar energy and the photovoltaic technology that had been the company’s historic business focus. A patent related to the company’s BioBacksheet for silicon solar modules remains among assets listed on the balance sheet. Nonetheless, BioSolar’s experience with silicon for solar cells has been a boon to figuring out how to use silicon in battery anodes.

BioSolar’s patent is among just a few assets on the company’s balance sheet. The company held $73,167 in cash in the bank at the end of June 2019. Given that it has been using about $60,000 a month in cash to support operations, the cash kitty does not provide much of a cushion against the bumps and bruises of the battery market. Since the quarter close, the company has raised $53,000 through the issuance of a convertible promissory note with a 10% interest rate.

Should investors take a stake in a tiny company with big dreams? Perhaps. However, BioSolar is likely to be palatable only for those with a very long investment horizon and willingness to wait for years to see revenue. It is noteworthy that in the past few weeks holders of convertible notes totaling $67,645 converted into common stock and accepted additional shares for payment of accrued interest. Conversion of debt to equity is not only conserving cash that would have otherwise been used for interest payments, it also demonstrates some level of confidence that management is executing according to plan.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 8/27/19 as “What Do Investors Get With BioSolar?”.