The MacArthur Foundation Invests In Climate Solutions- And In Fossil Fuels

By Marc Gunther.

Eighteen months ago, the people who manage the endowment at the John D. and Catherine T. MacArthur Foundation got some bad news: Investments they had made in funds managed by EnerVest, a Houston-based private equity firm that operates more than 33,000 oil and gas wells across the US, had plummeted in value to almost nothing.

The losses were small, relatively speaking — roughly $15 million, a fraction of the foundation’s $7 billion endowment — but they were unwelcome, if only because they called attention to the fact that MacArthur, whose mission is, famously, to build a “more just, verdant and peaceful world,” had...

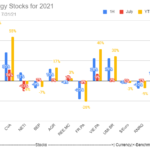

10 Clean Energy Stocks Updates: Green Plains Partners Refi; Covanta Buyout

By Tom Konrad, Ph.D., CFA

Second quarter earnings season is in full swing. Below are a couple updates and the monthly performance chart that I recently shared with my Patreon supporters.

Green Plains Partners Earnings and Future Dividend

(published August 2nd)

Ethanol Master Limited Partnership Green Plains Partners (GPP) declared second quarter earnings today. The main news remains the long anticipated debt refinancing and new dividend guidance going forward.

At the end of the first quarter, I predicted that, after debt refinancing, GPP would increase its quarterly dividend to something in the $0.25 to $0.30 range.

The new guidance is for the partnership to target...

The Rare Earth Supply Chain: Ores, Concentrates, Compounds, Oxides and Metals

REE Refining 101 by Kidela Capital Group “There is a reason why the Rare Earths are called rare. They’re not called rare because they’re truly rare. They’re called rare because it’s very difficult to isolate these elements individually and it takes a lot of skill to do that.” Constantine Karayannopoulos, chief executive of Neo Material Technologies1 Rare Earth Elements have become an indispensable part of modern life, found in everyday items like computers, camera lenses and high efficiency light bulbs to complex, emerging technologies in the optics, medical and defence spheres....

Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

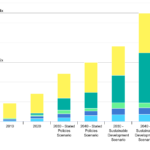

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

Seven Indian Clean Energy Stocks

by Sneha Shah Raja Ravi Varma's portrait of the Hindu goddess of wealth, Lakshmi, ലക്ഷ്മി ദേവി. via Wikimedia Commons Why Invest in Indian Green Energy India is set to become the 3rd largest market for wind energy after USA and China and is set to enter the top 10 club of countries in installing solar energy capacity in 2012. Massive power deficits, millions of people without power, billions of dollars in oil, gas and coal imports imply that India offers massive opportunities for renewable energy generation. In fact Indian solar ...

How to Invest in Clean Energy Webinar

Eventbrite sign-up: https://www.eventbrite.com/e/how-to-divest-from-fossil-fuels-and-invest-in-clean-energy-tickets-591429470467?keep_tld=1

Transmission – The Bottleneck We All Saw Coming

by Paula Mints

Transmission and distribution is the process of getting electricity from the point of generation to the point of use. Unfortunately, upgrades, maintenance, and the need to extend the electricity infrastructure from point a to point b are often ignored. Also ignored are infrastructure designs that support a distributed grid with renewable energy sources of electricity.

Transmission bottlenecks are the utterly foreseeable consequence of accelerated solar and

wind deployment. As countries worldwide were announcing RE goals, holding auctions, and providing incentives, system operators everywhere were warning about the need to add new and upgrade existing infrastructure while also warning about...

Energy Efficiency and Solar Lead Alternative Energy Stocks Skyward

By Harris Roen Industry Day Week Qtr Year Energy Efficiency -0.3% 2.3% 18.7% 49.9% Environmental -0.2% 1.1% 9.8% 11.8% Fuel Alternatives -0.3% 1.3% 19.6% 29.2% Smart Grid -0.1% 2.4% 9.5% 31.9% Solar 0.5% 6.8% 40.3% 52.8% Wind 0.0% 2.1% 9.7% 21.6% Average -0.1% 2.7% 17.9% 32.9% Data as of: 7/17/2013 Alternative energy stocks are up over 30% on average for the year, reflecting impressive gains off of widely oversold lows in 2012. Almost three-quarters of...

Geothermal, Battery, and Solar LED articles in TQ

There were three excellent alternative energy articles in last week's Technology Quarterly from the Economist. Readers know I'm an avid battery investor, and the Economist's in depth History of the Battery is well worth reading for anyone who wants to gain insight into the promises and challenges awaiting developers and investors. My favorite battery investment, Electro Energy, last profiled here has seen considerable selling, having lost half its price since its peak in early January. I still like the and own the stock. There is also a short article about the prospects for Enhanced Geothermal, one of my favorite...

List of Green Investment Advisors

If you want your money to help with the transition to the clean energy economy, most investment advisors will probably try to accommodate by finding a few green mutual funds for you.

There are now hundreds of mutual funds and ETFs that brand themselves as green, but many will not meet your definition of what is "green." This could mean not being completely divested from fossil fuels, investing in nuclear power, or owning too much of non-fossil fuel stocks like Apple (AAPL) and Facebook (FB) and not enough green-focused companies like Tesla (TSLA).

An investment advisor who does not consider values...

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

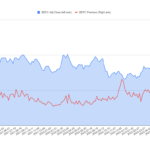

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

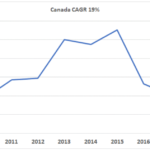

What Obama Did To Coal Investors, What The Next President Might, And How Investors...

by Tom Konrad Ph.D., CFA Investing in the past is a good way to lose money. Just ask anyone who has been investing in coal stocks since Obama we re-elected. A glance at the chart above shows that the VanEck Vectors Coal ETF (KOL) is down about 50% over the last four years, even while the broad market (as represented by the SPDR S&P 500 ETF (SPY)) has gained almost 50%. But even if we knew this was going to happen, should investors have rushed into the energy sectors most loved by liberals: That is, Wind, Solar,...

Green Energy Investing For Beginners: Index

Tom Konrad, CFA I write about investing in Renewable Energy, Energy Efficiency, and other green technologies because I'm worried. I'm worried that the inevitable transition away from fossil fuels driven by peaking supply and climate change could be much more painful than it needs to be because, as a society, we have massively underinvested in the infrastructure that we will need for the transition. I don't care if my readers are motivated by an altruistic wish to make the world a better place, or they just want to cash in on what promises to be the hottest stock market...

The Brookfield Renewable Energy Corporation Premium

By Tom Konrad, Ph.D., CFA

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse...

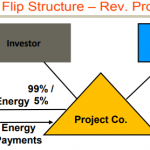

Solar Energy Industry Association (SEIA) Tax Equity Conference Brief

I recently attended the Solar Energy Industry Association's (SEIA) Finance and Tax Seminar in New York. The subject matter in this event delved into issues related to tax equity finance. Each panel session was moderated by a tax attorney or an accountant, and most of the content of the sessions consisted of technical tax law.

To place the discipline into context, one speaker noted that the tax equity renewables investing deal volume in 2018 was $2-3B for solar and $9B for wind, and the number of tax equity participants is roughly only 25-35 large corporations. So unless there are changes...

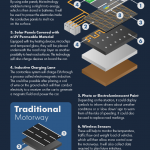

Roadway Revolution: Meet the Smart Highways of the Future

by Giles Kirkland

Even though many states seem to enter the “construction season” every spring, there’s still a significant backlog of vital repairs and improvements needed for state roads, interstates and bridges – around $420 billion worth as of 2017.

Not only are our roads falling apart, there are greater numbers of people in more vehicles on them. But what if, instead of simply following same repaving or rebuilding formula that never seems to catch up, municipalities get “smarter” with their fixes?

Smart cars use the newest technologies to save energy, improve safety, and assist in navigation. Missing from many of the...