At $126 billion transacted in 2008, up from $11 billion in 2005, the global carbon market is the fastest growing commodities market in the world and, provided that an agreement is reached at the COP15 conference in Copenhagen and that the US adopts a cap-and-trade program, this growth could go on for several more years.

Yet this is a market that remains comparatively unknown for a number of reasons, not the least of which is the fact that the rules surrounding it are very complex. Unlike other commodities, to successfully invest directly in carbon assets one must have a complete understanding of various layers of rules and regulations, starting at the top with broad public policy objectives all the way down to the minutiae of how carbon assets can be traded.

In early May, I wrote an article discussing how US investors could invest in emissions trading. In that article, I mostly ignored the iPath Global Carbon ETN (GRN) and the AirShares EU Allowances Fund (ASO) – the two ETF/ETNs that track European carbon prices – because the article focused on US carbon emissions and neither has exposure to US emissions markets such as the RGGI or the CCX.

These two products, launched in the past year, provide investors with direct exposure to carbon contracts. In a way, they are a much more direct means of expressing one’s view on the carbon market than going through the back door by owning an exchange such as Climate Exchange PLC (CXCHY.PK) or a trading platform like World Energy (XWES).

Although I first discussed GRN and ASO in early January, I never researched either of them in any detail. Yesterday, I looked into how they had been performing in 2009. The graph below shows their performance over the past six months.

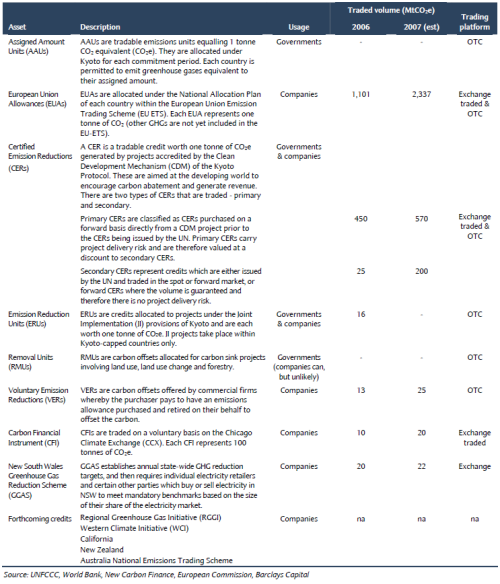

What accounts for GRN’s seeming outperformance (I haven’t checked for statistical significance) is the composition of the underlying portfolio of carbon assets. The following table provides a summary of the main carbon assets traded around the world (for a larger table, you can download the Barclays Capital report from which I took it and scroll to page 4).

Currently, the most liquid and active carbon markets are for the EU ETS’ EUAs and secondary CERs (see table above). I will not cover the rules of the EU ETS in this article, but you can find a detailed overview of the program here. In 2008, out of a total of about $126 billion transacted on international carbon markets, EUAs accounted for $92 billion and secondary CERs $26 billion – together, they made up roughly 94% of transacted value.

EUAs must be surrendered to governments by regulated companies each year in an amount equivalent to the company’s emissions. CERs can also be used toward meeting regulatory requirements, although their use is capped at 13.5% of total permit requirements in the EU ETS (this varies by country). CERs thus tend to trade at a discount to EUAs even though the marginal cost of abatement might be lower in the emerging economies where they are generated.

GRN Vs. ASO

Although they both hold carbon futures contracts transacted on the European Climate Exchange, GRN and ASO are set-up very differently.

ASO, according to information available on its website, holds a basket of EUA futures of different vintages – that is, of different compliance years – that is rolled over annually. You can view the current portfolio here. ASO holds the futures until shortly before the EUAs come due in December of each year, at which time it sells them and uses the proceeds to invest “in futures contracts expiring in December of the next five subsequent years […]” Since ASO is not a regulated entity under the EU ETS, there is no sense in the fund taking physical delivery of the EUAs.

GRN, on the other hand, holds a basket of EUA (~79%) and CER (~21%) futures. The weights are determined annually by a committee and the index is re-weighted in November of each year. The other major – and, arguably, more important – difference with ASO is the fact that GRN holds only current year contracts. When it is re-weighted each November, the futures for period T (current year) are thus entirely replaced with futures for period T+1.

GRN is heavily leveraged to near-term market developments, whereas ASO takes a longer-term view.

Conclusion

Because ASO looks five years out, a strong agreement in Copenhagen in December would be favorable for the fund, as the EU has indicated that it would raise its greenhouse gas reduction target from 20% below 1990 level by 2020 to 30% below 1990 by 2020 if such an agreement were reached. The 2013 futures then held by ASO following the annual roll would most likely experience a pop.

Additionally, if the US were to join the carbon trading club by the end of the year, the long-term picture would brighten substantially, which again might favor ASO.

Besides these macro events, I don’t currently have a view on which security is superior as I haven’t done sufficient analysis of the EU ETS yet. This is something I intend to do in the next few weeks and months, as I think interest in this commodity will grow substantially in the lead-up to Copenhagen.

DISCLOSURE: None

UPDATE (JULY 28, 2009): A reader alerted me to this: http://www.indexuniverse.com/sections/newsinfocus/6256-xshares-to-close-carbon-etf-.html – ASO has now been withdrawn. Not especially surprising in my opinion.