Charles Morand

On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly “important”. The note claimed: “[w]e believe smart investors and companies […] will recognize the edge they can gain by understanding low carbon trends.” I couldn’t agree more with that statement.

It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was releasing its latest report at event organized by BofA/ML in NYC.

I am fairly familiar with the CDP, having worked on one of the reports in 2006. In a nutshell, the CDP sends companies a questionnaire covering various topics such as greenhouse gas (GHG) emissions, programs to manage the identified risks of climate change, etc. (you can view a copy of the latest questionnaire here). The responses are then aggregated and made into a publicly-available report.

The CDP purportedly sends the questionnaire on behalf of institutional investors who are asked to sign on to the initiative but have no other obligation. The CDP currently claims to represent 475 institutional investors worth a collective $55 trillion. Not bad!

Putting Your Money Where Your Signature Is?

Despite their best efforts, initiatives like the CDP or the US-based CERES are mostly inconsequential when it comes to where investment dollars ultimately flow. Investors are asked to sign on but are not required to take any further action, such as committing a percentage of assets under management to low-carbon technologies or avoiding investments in companies with poor disclosure or that deny the existence of climate change altogether.

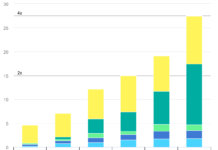

Case in point, the latest Global Trends in Sustainable Energy Investment report found that, in 2008, worldwide investments in “sustainable energy” totaled $155 billion. That’s about 0.28% of the $55 trillion in assets under management represented by CDP signatories. A mere 1% commitment annually, or $550 billion for 2008, would substantially accelerate the de-carbonization of our energy supply, probably shrinking the time lines;we’re currently looking at in several industries to years rather than decades.

And that’s ok. By-and-large, investors are investors and activists are activists. In certain cases, investors can be activists, either from the left side of the political spectrum with socially-responsible funds or from the right side with products like the Congressional Effect Fund. But overall, most sensible people want investors to be investors.

That’s because the function that investors serve by being investors rather than activists is a critical one in a capitalist system – they force discipline and performance on firms and their management teams. By having to compete for capital with other firms in other sectors, clean energy companies have an incentive to crank out better technologies at a lower cost, and that process will have positive implications for all of society in the long run.

The problem with the CDP is that it’s really an activist organization parading as an investor group. If the Sierra Club were to go around and ask Fortune 500 companies if they wanted to be hailed as environmental leaders in a glossy new report with absolutely no strings attached, I bet you anything they would get 475 signatures in a matter of days. And so it goes for CDP signatories – institutional investors the world over get to claim that climate change keeps them up at night while not having to deploy a single dime or alter their asset allocation strategies.

Approaching Climate Change Like An Investor

Someone approaching climate change like an investor – that is, as a potential source of investment outperformance (long) or underperformance (short or avoided) – isn’t likely to care for activist campaigns aimed at forcing large corporates to disclose information on the matter; in fact, they may prefer less public disclosure to more.

That is because one of the greatest asset an investor can have is an informational advantage. In the case of climate change, those of us who believe that it’s real and who think they can put money to work on that basis have a pretty good idea where to look and what to look for – we don’t need the SEC to mandate disclosure. Those who think it’s one giant hoax couldn’t care less – they don’t need the SEC to get involved, either. Yet this is where such campaigns are going, according to the BofA/ML report.

I like to think of climate change as an investment theme in terms of three main areas: (1) Physical, (2) Business, and (3) Regulatory. All three areas present investment risks and opportunities.

| Opportunity | Risk | |

| Physical | DESCRIPTION: Companies that stand to gain from strengthening or repairing the physical infrastructure because of an increased incidence of extreme weather events or a changing climate. Examples include electric grid service companies such as CVTech Group (CVTPF.PK), Quanta Services Inc (PWR) and MasTec Inc. (MTZ).

|

DESCRIPTION: Companies that stand to be negatively impacted by more frequent and more powerful extreme weather events, or by a changing climate. Examples include ski resort operators, sea-side resort operators and property & casualty insurers. TIMELINE : Long-term |

| Business | DESCRIPTION: Companies that provide technologies and solutions to help reduce the carbon footprint of various industries, be it power generation, transportation or the real estate industry. Renewable energy and energy efficiency are two obvious examples.

TIMELINE : Immediate |

DESCRIPTION: Companies that make products that increase humanity’s carbon footprint and that could fall out of favor with consumers on that basis. Examples include car makers with a large strategic and product focus on SUVs and other needlessly large vehicles. TIMELINE : Medium-term |

| Regulatory | DESCRIPTION: Firms that have direct positive exposure to the regulatory the responses to climate change enacted by governments. Examples include firms that operate exchanges or auction/trading platforms for carbon emission credits such as Climate Exchange PLC (CXCHY.PK) and World Energy (XWES).

|

DESCRIPTION: Companies that are in the regulatory line of fire for carbon emissions. Coal-intensive power utilities are a good example, as are other energy-intensive industries that might have a limited ability to pass costs on to consumers because of high demand elasticity or fierce competition.

TIMELINE : Near-term |

This categorization provides a high-level framework for thinking about what may be in store for investors as far as climate change goes. However, with the exception of Business/Opportunity and Regulatory/Opportunity, the investment case is not necessarily clear-cut and requires some thinking.

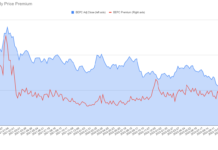

For instance, oil would seem like a perfect candidate for the Business/Risk category were it not for another major and more powerful price driver: peak oil. As for Regulatory/Risk, the European experience thus far has shown how open a cap-and-trade system is to political manipulation, and firms there have been able to withstand the regulatory shock more because of achievements on the lobbying side than on the operational side. That is why I have stressed in the past that understanding emissions trading was more about understanding the rules and the politics than about understanding the commodity.

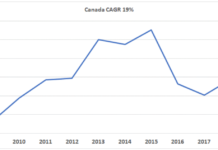

Nevertheless, these trends are worth following for people who: 1) like investing and 2) think that climate change is not the greatest hoax ever perpetrated on the American people. For instance, CVTech Group (CVTPF.PK), a small Canadian electrical network services company, reported that in fiscal 2008 around 58% of its annual revenue increase (C$23.0 MM) was due unscheduled electricity infrastructure repairs as a result of hurricanes in Texas, Louisiana, North Carolina and South Carolina. In the annual report, management noted: “Since 2005, an increase in the occurrence of hurricanes has resulted in growing demand for our services in these states.”

Conclusion

I have nothing against the concept of activist organizations going after corporations with various demands, be they influenced by left- or right-wing thinking; after all, we live in a free, open society and it’s everyone’s right to do so within the confines of the law.

What I don’t like quite as much is hypocrisy and greenwashing. As far as I go, if an institutional investor truly believes that climate change can be a worthwhile investment theme, they should put a couple of analysts on it and figure out how to put money to work. If they don’t believe that it is, then they should just go on doing what they do best: manage money.

What they shouldn’t do is pretend to see an investment risk or opportunity where they really don’t just to appease a handful of vocal stakeholders. Lobbying to get the SEC to force disclosure on climate change is nothing more than window dressing; investors who think this is real already know where to look and what to look for and – surprise, surprise – it’s not rocket science!

DISCLOSURE: None

The impact of climate regulation on coal-intensive power utilities could actually be positive, if the industry manages to grab sufficient carbon-credit giveaways. Just as happened in Europe, coal utilities may be able to easily reduce carbon emissions, and then sell extra carbon credits on the market, creating a windfall.

A better place to look for an industry facing regulatory risk from a carbon cap and trade is the coal *mining* industry, which may see decreased demand for their product under cap and trade.

Absolutely. Another aberration of the EU ETS occurred last fall when, as credit markets were freezing up, certain corporates sold their free government-granted emission allowances into the market and went long call options with exercise dates just before they were due to comply. This allowed them to beef up their liquidity reserves at a fraction of the prevailing market rate for capital. Although that’s very clever, that’s certainly not what the system was intended for and all of that opportunistic trading introduces inefficiencies and creates cynicism population.

Notice how I didn’t zero-in on cap-and-trade in the table in case certain jurisdictions opt for a carbon tax which, albeit theoretically less efficient, is far easier to administer and far harder to game.

Re: Carbon Tax- Everyone seems to say they are harder to game, but I wonder if it’s true. Have you seen the US income tax system recently? (I don’t know if Canada is a bad, but it probably is.)