Tom Konrad Ph.D., CFA

Ten Years of “10 Clean Energy Stocks.” A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don’t know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was an investment advisor, the restrictions of compliance made it virtually impossible to make stock picks. And specific stocks was precisely what I found most interesting, and what readers were crying out for.

By the start of 2008, I had decided to go back to private money management and stop trying to get clients through my writing. Eventually I folded my public investment advisory business altogether. This freed me to write about stocks. At the start of 2008 (not the most auspicious year for investing, green or otherwise) I took stock picking to its logical conclusion, and gave readers “Ten Alternative Energy Speculations for 2008.”

The two best calls I made with that list were:

- Being very clear that the list was full of “speculations” and “gambles,” and

- Including First Solar (FSLR) as a stock to short at $267.

The list was full of companies that are now bankrupt, or which have spent the last decade going nowhere. First Solar, while a great company with great technology, was trading at $267. Today, it has dropped the “2” in “267” and is still down 75%, but well up from a low of $15 in 2012.

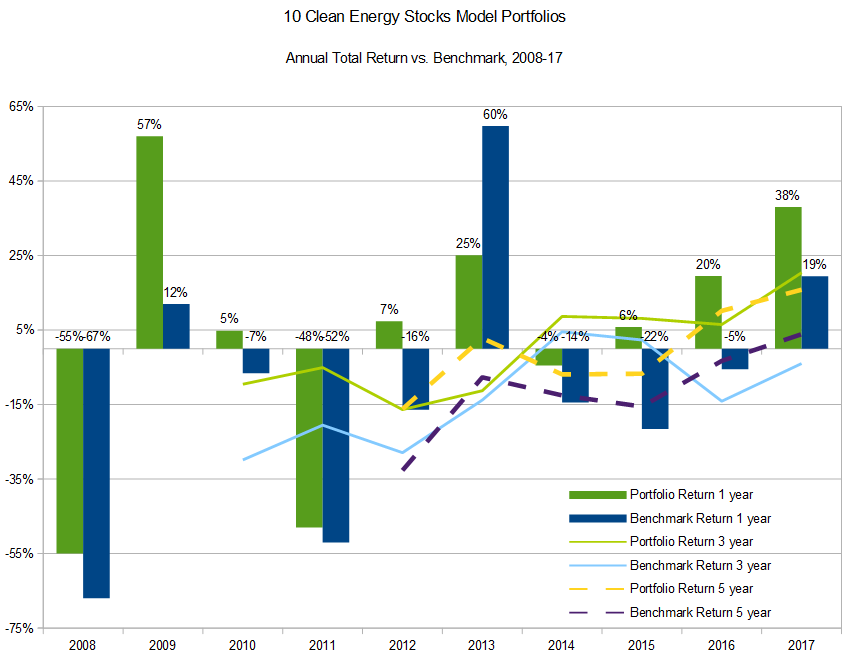

In short, the 2008 list was a debacle from an investing standpoint, a problem compounded by the 2008 financial crisis. While the list still outperformed the dismal two-thirds decline of its benchmark (PBW.) In the years since, the list is focused more and more on more conservative clean energy companies rather than speculations. Where the model portfolio was once just less bad than most clean energy ETFs, it is now producing more consistent performance that any money manager would be proud of.

Over the past five years, the more cautiously designed model portfolio has produced a compound annual return of 15.7%, compared to 3.9% for its benchmark. Although I doubt we’ll see another giant return like 2017 in the year to come, I think the new approach is likely to avoid the giant losses like those in 2008 and 2011. While the 38% return in 2017 is impressive, I’m more proud of the 6% return in 2015, when other clean energy stocks cratered with the bankruptcy of SunEdison and the popping of the Yieldco bubble.

With my more recent approach producing such strong and consistent results (in contrast to the wild swings of the early years), I plan more of the same in 2018. Instead of more exciting alternative energy plays, I will focus entirely on the more boring income stocks that compose my own actual portfolio and the private Green Global Equity Income Portfolio (GGEIP) that I have managed for the last four years. Coincidentally, GGEIP has also produced a compound annual total return of 15.7% for the four years through the end of November. Its benchmark, the SPDR S&P Dividend ETF (SDY) is up a compound annual 10.4%.

Benchmarks

Last January, I used a weighted average of the Global X YieldCo ETF (YLCO) and the Powershares Clean Energy ETF (PBW) as my benchmark. The 80% weight on the income-focused YLCO reflected the 8 of 10 income stocks in the portfolio, while the 20% weight on PBW matched the two growth stocks. Since the focus of the model portfolio will be purely income stocks this year, I plan to completely drop PBW as a benchmark, and use only YLCO. I will supplement YLCO with SDY, as a benchmark for the performance of the broad portfolio of income stocks.

The Making of 10 for 2018

Over the last few decades, stock market research has poked a number of gaping holes in the basic assumption of Modern Portfolio Theory that, other than diversification, there is no reliable way to reduce portfolio risk without sacrificing expected returns. Several of these potentially counter-intuitive findings have become important to my investment selection process:

- Selecting high dividend stocks reduces portfolio risk without reducing expected returns. When the stocks are small and mid-cap stocks, expected returns actually increase. (What Difference Do Dividends Make? C. Mitchell Conover, CFA, CIPM, Gerald R. Jensen, CFA, and Marc W. Simpson, CFA)

- Selecting stocks with low market correlation (Beta) or low volatility reduces risk without sacrificing returns. (Low-Risk Investing without Industry Bets Clifford S. Asness, Andrea Frazzini, and Lasse H. Pedersen, and many others.)

- Small capitalization stocks and stocks with lower liquidity tend to outperform their larger and more liquid counterparts. (Liquidity and Stock Returns, Yakov Amihud and Haim Mendelson)

- Selecting a portfolio of individual stocks is a more effective way to take advantage of multiple such market anomalies than buying a collection of “Smart Beta” ETFs, which only focus on anomalies individually. (Fundamentals of Efficient Factor Investing, Roger Clarke, Harindra de Silva, CFA, and Steven Thorley, CFA)

You will find that this year’s list tilts towards high dividends (average yield 6%), and low Beta (average 0.64 – anything less than 1 is considered low.). All are small capitalization stocks, or near that range ($300 million to $2 billion) in market capitalization. Other factors I consider are traditional value metrics such as profitability, EV/EBITDA, Price to Book ratio, and dividend coverage, trading of the stock by company insiders, and my own person estimate of just how “green” the company is. I’ve also added my own estimates of the risks and potential rewards likely to be produced by the recent Republican tax bill and possible future legislation.

Only Green

I believe that technology continues to advance, and that the world and individual US states will continue confronting our environmental problems no matter what the federal government does. I’m also a moral investor, with the core belief that the actions taken by companies I invest in are as much my moral responsibility as actions I take myself.

Hence, I only consider green companies for this list and my managed portfolios. That does not mean just wind, solar and electric cars. It means that the company should be doing net good for the environment. For each company, I ask myself:

“If this company did not exist, would the environment be better off?”

If the answer is “worse,” then I’ll consider the company for my portfolio. This can lead to a few unconventional picks. In this list are companies involved in energy from waste (Covanta (CVA)) and container shipping (Seaspan SSW). Electricity distribution company InfraREIT (HIFR) is not obviously green, but the electric grid is an essential enabler of the broad adoption of renewable electricity such as wind and solar. These companies are, in my opinion, better for the environment than the alternatives (landfills, air transport or less efficient container shipping, and trying to power a home or business solely with onsite generators.) You may disagree on these admittedly qualitative judgements. If you do, you should omit these specific stocks from you portfolio.

Yieldcos and Other Infrastructure Stocks

Yieldcos are companies with a business focused on the ownership or financing of operating clean energy assets, and use most of the resulting cash flow to pay dividends to shareholders. Operating clean energy assets include wind farms, solar farms, biomass and biofuel plants, and other sustainable infrastructure which reduces overall greenhouse gas emissions. Yieldcos often have a developer “sponsor” which holds a majority of the Yieldco’s stock, and gives the Yieldco the first opportunity to buy many of the developer’s projects, called a “Right of First Offer” or ROFO.

Because Yieldcos own existing infrastructure and sell renewable energy, they are much less dependent on the continuation of government subsidies for clean energy than many renewable energy companies that have to sell or install products to make a profit. The stability of Yieldco cash flows (and dividends) depend much more on counter-parties (usually investment grade utilities) living up to their obligations than on government policy.

For the past few years, these 10 Clean Energy Stocks lists have been fairly heavily weighted towards Yieldcos, due in large part to my preferences for a high level of dividends from stable cash flows. This year, every stock in the list follows that same basic model: ownership (and, in most cases, operation) of long-lived infrastructure assets with income provided by long term contracts. I would not generally include InfraREIT or Seaspan in my lists of Yieldcos because they tend to stretch the definition of “clean energy infrastructure,” but their basic business model is very similar to that of Yieldcos, and they have very stable businesses for a similar set of reasons. While I did not set out to create an “All Yieldco” list, that’s what fell out when I looked at the current valuations of the stocks I follow.

The New Tax Bill

For most of 2017, the stock market has been rising on the promise of a hefty corporate tax cut. Now that the Republicans’ gift to corporations and shareholders is law, I expect that the rally will slow, if not stop, based on the old market adage, “Buy the rumor, sell the news.”

The benefits of that tax cut were always likely to be limited for Yieldcos, and so the end of the tax-cut rally should have minimal effect on them as well. Most Yieldcos pay very little tax because their profits are generally shielded by large levels of depreciation and clean energy tax credits, so a cut in the corporate tax rate should have limited effects on their profitability going forward. While most of the companies in this list did not participate in the rally, they should likewise not be hurt by the decline.

A good measure of how much any of these companies will be affected by the tax cut is the percentage of their distributions that have recently been treated as return of capital. I’ve listed the percentage of their recent distributions which were treated as return of capital in the table below. Domestic corporations with low return of capital will see greater benefits from the tax bill. The last four stocks in the list are organized as pass-through entities (InfraREIT is a REIT, while the other three are limited partnerships.) For these, 20% of the part of the distribution which would have otherwise been taxable can be deducted from the shareholders’ income in 2018.

Ten Clean Energy Stocks for 2018

Below is the Ten Clean Energy Stocks for 2018 list, along with some of the metrics discussed in the stock selection section above. Data is as of 12/31/2017.

| Company |

Ticker |

Yield |

Beta |

Market Cap |

Insider Buying |

Green |

% Return of Capital |

| Seaspan Corporation | SSW |

7.3% | 0.3 | $760M | Strong buying | Somewhat | 100% |

| Covanta Holding Corp. | CVA | 5.8% | 1.0 | $2.2B | Some buying | Mostly | 0% |

| NRG Yield | NYLD or NYLD/A |

0.2 | $2.6B | Strong buying | Mostly | 100% | |

| Atlantica Yield | AY | 0.5 | $2.1B | None | Mostly | 37% | |

| Pattern Energy Group | PEGI | 0.4 | $2.1B | Selling | Completely | 100% | |

| Terraform Power | TERP | 0.3 | $2.3B | None | Completely | 100% | |

| Brookfield Renewable Partners, LP | BEP | 0.1 | $11B | None | Completely | 35% | |

| Green Plains Partners, LP | GPP | 0.5 | $570M | Some selling | Completely | 100% | |

| InfraREIT, Inc | HIFR | 0.4 | $1.1B | Some buying | Somewhat | 0% | |

| Enviva Partners, LP | EVA | 1.2 | $730M | Some buying | Completely | 100% |

Stock discussion

Below I describe each of the stocks and groups of stocks in more detail. I include with each stock “Low” and “High” Targets, which give the range of stock prices within which I expect each stock to end 2018.

Seaspan Corporation (NYSE:SSW)

12/31/17 Price: $6.75. Annual Dividend: $0.50 (7.4%). Expected 2018 dividend: $0.50 (7.4%). Low Target: $5. High Target: $20.

Seaspan is a leading independent charter owner of container ships. On the whole, its fleet is newer, has larger capacity, and is more efficient than the worldwide fleet. In addition to its common shares (SSW), Seaspan also has a number of publicly preferred share issues, one of which (SSW-PG) was included in Ten Clean Energy Stocks for 2017.

At the start of 2017, shipping was in the midst of a deep downturn. Although Seaspan’s business model renders it one of the most stable companies in the industry, I and many other observers expected the company to cut its dividend during the year, which would make the stock decline. The dividend was cut by two thirds, and the common stock fell from $9.14 a year ago to below $7 today. Meanwhile, the preferred shares rose from $19.94 to $24.17 as I write on December 28th while paying $2.05 worth of dividends.

Today, the shipping industry is experiencing a recovery of growing strength, and so it makes sense to own shares which are more likely to benefit from that recovery. Preferred shares offer a fixed dividend, and so it made sense to own them in an environment where dividend cuts were expected, especially since we were able to buy them at a 20% discount to their $25 par value. Today, the preferred shares are trading at only a 3% discount to par, and so the potential for future gains beyond the dividend is limited. The common shares, however, are trading at a 7.3% yield with dividend payments approximately equal to recovering GAAP earnings and a fraction of cash flow available for distribution.

With a high, safe dividend in a recovering industry, Seaspan’s common stock could easily double over the next year. The stock does hold some risks, however. In my mind, the largest of these is the risk that the Trump administration starts a worldwide trade war, or even a real war. Either of these could scuttle the recovery of the shipping industry and Seaspan’s profits.

Covanta Holding Corp. (NYSE:CVA)

12/31/17 Price: $16.90. Annual Dividend: $1.00(5.9%). Expected 2018 dividend: $1.00 (5.9%). Low Target: $15. High Target: $25.

Covanta is the US leader in the construction and operation of waste-to-energy plants. These plants incinerate trash (often called municipal solid waste or MSW) and use the resulting heat to generate electricity. Recyclable metals are recovered from the ash.

Waste to energy has a bad name among many environmentalists because it is a less valuable use for recyclable materials, and because improperly operated incineration of waste can lead to toxic emissions, such as dioxins, especially if the combustion temperature is too low. I include Covanta as a green stock because, as I discussed above, I believe its operations are a net positive for the environment. The MSW Covanta burns includes some recyclables, but this is also true for any MSW which is headed for landfills. In a landfill, the organic component of MSW emits methane which is an extremely powerful greenhouse gas, and the incineration allows the recovery of metals which would otherwise be landfilled. Electricity generated from waste displaces electricity which might otherwise be generated from fossil fuels.

When it comes to dangerous pollutants from incineration, Covanta has shown that it has the technical capabilities to operate safely, and emissions from incineration must also be compared to emissions from landfills and from the electricity generation that Covanta’s operations displace. Nevertheless, less stringent emissions enforcement under Trump’s EPA may improve profitability by cutting down on paperwork.

Covanta was in the 2017 list, and until mid-December looked like it would be the only stock in the list to produce a single-digit return. It was being held back by worries about how it would fund its significant expansion plans. Those worries were laid to rest on December 18th when the company announced a strategic partnership with Green Investment Group (GIG), a subsidiary of leading infrastructure investment manager Macquarie, and Europe’s largest green energy investor. GIG and Covanta will pool the 6 projects in their UK development pipelines, which will be developed and owned by a joint venture between the two. Covanta’s capital contribution for the next four projects will be funded by GIG buying in to Covanta’s recently completed Dublin project at a large premium to its construction cost. Finally, Covanta will operate (at market rates) Dublin and the other projects to be developed by the joint venture.

Covanta should also get a significant financial boost in 2018 from the Republican tax cut.

NRG Yield, A shares (NYSE: NYLD and NYLD/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

Despite the fact that NRG Yield’s sponsor, NRG, is looking for a buyer for its stake, NRG Yield remains one of the more attractively valued Yieldcos. In November it issued guidance for 2018. Its 2018 dividend growth target is 15% while it keeps its payout ratio (relative to Cash Available for Distribution, or CAFD) of 80%. CAFD guidance is $280 million, or about $1.50 per share, which would allow an annual dividend of $1.20 per share at an 80% payout ratio without the purchase of additional projects in 2018. Since new projects will only need to increase CAFD by 5% in order for the Yieldco to hit its dividend growth target, I’m fairly confident that it can do so.

There may be an additional price boost for the Yieldco if NRG is successful in selling its stake to a strong new sponsor. But even without a new sponsor, there should be plenty of opportunity for the Yieldco to buy the projects it needs. With the stock at current levels, the main limiting factor to its expansion is cost of capital, not a lack of projects. It still has a Right of First Offer on a large array of current and future projects from NRG, as well as opportunities to buy projects from third parties.

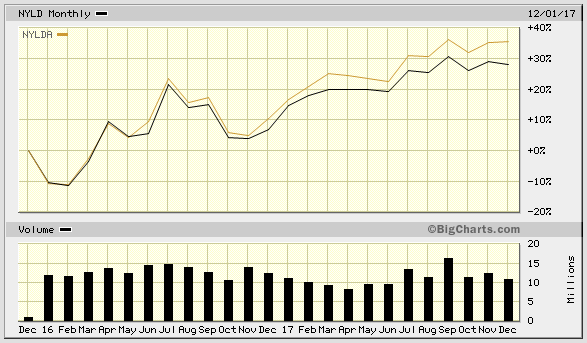

NRG Yield has two publicly traded share classes. Both share classes pay the same dividend, but there are significantly more class C (NYLD) shares outstanding, and this share class has more liquidity because of higher trading volumes. The A shares (NYLD/A) have 100 times the voting rights. Historically, class A shares have traded at a significant discount to class C shares, most likely because of the greater liquidity of class C shares. Because the lower price for A shares led to a better valuation and higher yield compared to C shares, I chose to include NYLD/A rather than NYLD in the Ten Clean Energy Stocks lists for 2016 and 2017. As you can see from the chart,

that choice boosted performance by about 15% over two years. At the end of 2017, however, class C price premium is negligible, with NYLD trading at $18.90 compared to $18.85 for NYLD/A. For the purposes tracking model portfolio returns, I shall list both prices and use an average of the two share classes over the course of the year to calculate returns. I suggest that readers looking to buy NRG Yield purchase whichever share class is less expensive when they make the trade.

Atlantica Yield, PLC (NASD:AY)

12/31/17 Price: $. Annual Dividend: $1.16(%). Expected 2018 dividend: $1.39. Low Target: $18. High Target: $30.

Atlantica is back in the model portfolio for the second year. I included it in the 2017 list because it was recovering from the after-effects of the bankruptcy of its former sponsor, Abengoa.

Atlantica succeeded in finding a new sponsor, Algonquin Power and Utilities (AQN), another long term holding of mine, but one that I’ve written about less than I should. Algonquin is purchasing a 25% interest in Atlantica from Abengoa with the option to acquire the remaining 15% any time before March. The purchase price was $24.25 per share plus a possible $0.60 per share contingency payment, amounting to a 15 to 18 percent premium over the current price. The two companies are a good fit in that they both have expertise investing in a broad array of electric and water infrastructure with an emphasis on clean energy, but in complementary locations. Algonquin’s assets are mostly in North America, while Atlantica’s are mostly in Spain and Latin America.

Atlantica owns more concentrating solar power plants than any other Yieldco, including two US plants, Solana and Mojave, that were built by Abengoa with loans from the Department of Energy (DOE) as part of the post-financial crisis stimulus. These loans came with the condition that Abengoa maintain a certain financial stake in the plants because, at the time, Abengoa’s ownership was seen as an assurance of financial security. With Abengoa’s bankruptcy, Atlantica needed to obtain waivers of these requirements from DOE and some of its other lenders. These waivers are virtually complete, although the DOE will need to grant further waivers if Abengoa is to sell its remaining stake in Atlantica to Algonquin or anyone else.

Although Atlantica’s current yield is much lower than many other Yieldcos’, this is because it has been very cautious raising its dividend after cutting it when Abengoa went bankrupt. That caution has left Atlantica with the resources to invest in new projects and/or quickly raise its dividend in 2018. I expect some combination of both in 2018.

Pattern Energy Group (NASD:PEGI)

12/31/17 Price: $21.49. Annual Dividend: $1.688(7.9%). Expected 2018 dividend: $1.70(7.9%). Low Target: $20. High Target: $30.

Pattern is a Yieldco owning mostly wind projects in North America. Its stock has pulled back over the last few months because the company is currently using nearly all its available cash flow to pay its dividend. Management has stated that it wants to bring the ratio of its dividend payments to cash flow available for distribution down to 80% over the next few years. This means that dividend growth will continue to slow in order to allow cash flow. Because of this, I expect that we will see low single digit dividend growth over the next few years. While this may be disappointing to shareholders who have gotten used to two percent dividend growth every quarter, I find it quite adequate when the stock is already trading at a 7.9% yield.

Terraform Power (NASD: TERP)

12/31/17 Price: $11.96. Annual Dividend: $0. Expected 2018 dividend: $0.72 (6.0%) Low Target: $10. High Target: $16.

Terraform Power is beginning its life under a new sponsor in Brookfield Asset Management (BAM.) BAM has a long and successful history managing Yieldcos and similar companies, with the chief example Brookfield Renewable Partners (BEP, discussed below.) Unlike other Yieldcos, BEP did not overextend itself in the 2015 Yieldco bubble, and has been able to consistently raise its dividend by 5 to 9 percent and maintain an 80 percent payout ratio for many years.

Brookfield Asset Management has a similar vision for Terraform, starting with a $0.72 dividend in 2018 and growing at a similar high single digit annual rate. I expect the stock to advance slowly and steadily once the Yieldco re-initiates its dividend in the first quarter.

Brookfield Renewable Partners, LP (NYSE:BEP)

12/31/17 Price: $34.91. Annual Dividend: $1.872(5.4%). Expected 2018 dividend: $2.02(5.8%). Low Target: $28. High Target: $45.

Brookfield Renewable Partners should continue its slow and steady dividend growth in 2018, but the increase may come in at the top of the historic range as it integrates its share of the assets of Terraform Global (GLBL.) Unlike Terraform Power, which BAM purchased for a combination of cash and stock, BAM and BEP bought Terraform Global outright. The merger closed on December 28th, and the purchase of the assets could lead to a slightly larger than usual dividend increase for BEP in 2018. BEP typically raises its dividend in the first quarter of the year.

While I don’t expect the stock to head for the stratosphere, I consider BEP an essential long term holding among Yieldcos because of its unique asset base. Although it is diversifying into wind and solar with the Terraform Global acquisition, its core holdings are hydropower. As renewable energy technologies become an ever-growing part of the electric grid, the ability of hydropower to control its output to balance fluctuating generation from wind and solar will become increasingly valuable.

US based shareholders may see some benefit from the increased deductibility on the portion of the income from BEP which is not capital gains. Offsetting this with be the continued 15% Canadian tax withholding on the rest of its distributions. While this foreign tax withholding can be applied as a credit on federal income tax, not all taxpayers will able to use the credit in full.

Green Plains Partners, LP (NASD: GPP)

12/31/17 Price: $18.70. Annual Dividend: $1.84(9.8%). Expected 2018 dividend: $1.90(10.2%). Low Target: $13. High Target: $27.

Green Plains Partners is a Yieldco organized as a Master Limited Partnership and specializing in ethanol refining and transportation. It is almost entirely dependent on on its sponsor, Green Plains Renewable Energy (GPRE) for its income. Its contracts with GPRE mostly insulate the Yieldco from downturns in the wildly cyclical ethanol business, but such contracts will not protect the Yieldco if the ethanol industry faces challenges which threaten the sponsor’s own survival.

The ethanol industry is currently in a strong profitable phase, but ethanol stocks have fallen in 2017 because of worries that the Trump Environmental Protection Agency (EPA) will weaken the Renewable Fuel Standard, which obligates oil refiners to buy specified volumes of ethanol. The EPA sets annual targets for volume obligations of ethanol and other biofuels, and the final ruling came as a disappointment to most biofuel producers. For conventional ethanol producers like GPRE and GPP, the volume obligation was okay, if not what they had hoped for, and this should underpin steady profits at GPP with continued growth through drop-downs from GPRE.

The risk that the EPA will deal some fatal regulatory blow to the ethanol industry at the behest of President Trump’s oil-industry cronies is largely mitigated by ethanol’s many friends in the Republican controlled Congress. After a year in which GPP’s stock price has slowly declined while its dividend has slowly been inching up, the ethanol Yieldco is looking like an excellent value stock at the start of 2018.

InfraREIT, Inc. (NYSE: HIFR)

12/31/17 Price: $18.58. Annual Dividend: $1.00(5.4%). Expected 2018 dividend: $1.00 (5.4%). Low Target: $16. High Target: $30.

InfraREIT is a unique Real Estate Investment Trust which owns electricity transmission in Texas, mostly in the Panhandle region and the north central part of the state. Much of this transmission services West Texas wind farms; all earns a safe, regulated rate of return. The company has the potential to grow by servicing the growing needs of wind and solar generation in the region, and drop downs from its private sponsor, Hunt Consolidated.

The stock has fallen over the last couple months due to stalled earnings growth. The lower stock price presents an opportunity to buy at an attractive valuation and benefit from the ability to write off 20% of pass through income in 2018 under the new Republican tax bill.

Enviva Partners, LP. (NYSE:EVA)

12/31/17 Price: $27.65. Annual Dividend: $2.46(8.9%). Expected 2018 dividend: $2.65 (9.6%). Low Target: $25. High Target: $40.

Enviva is the leading manufacturer of wood pellets in North America. It is a Yieldco organized as a Master Limited Partnership. Its wood pellets are largely shipped though Enviva owned facilities to large electricity customers in Europe.

Enviva returns to the 2018 list after a brief hiatus in 2017 when I sold my stake after the November election. I was concerned that Trump’s plans to pull out of the Paris Climate agreement and generally back away from the United States’ environmental obligations might lead Europe to question its own commitment to dealing with the climate crisis or perhaps retaliate against the US by undermining the role of wood pellets in the their own electricity generation mix. It now appears that Europeans are as committed to their climate goals as ever, and Enviva’s wood pellets seem safe in their role as part of the European climate solution.

While I don’t believe that burning wood pellets for electricity is nearly as green as wind or solar, claims that they are worse than coal are overblown. Such claims are based on the assumption that entire forests are cleared just to create wood pellets. In Enviva’s case, at least, this is not the case. Five of six of Enviva’s plants have sustainability certifications from the Forest Stewardship Council™ (FSC®) program, and all are certified to the (somewhat less rigorous) Sustainable Forestry Initiative® (SFI®) fiber sourcing standard. When mature trees are harvested for lumber, the limbs and smaller parts are used by Enviva to produce wood pellets. If mature trees were cut down for the sole purpose of making wood pellets, that might indeed be nearly as bad as burning coal, but that is not what is going on here.

Since I dropped Enviva from the annual list at the start of 2017, the stock has barely moved in price, but the dividend has increased by 16% and its risks have generally declined. The time seems ripe to bring Enviva back into the list for 2018.

Final Thoughts

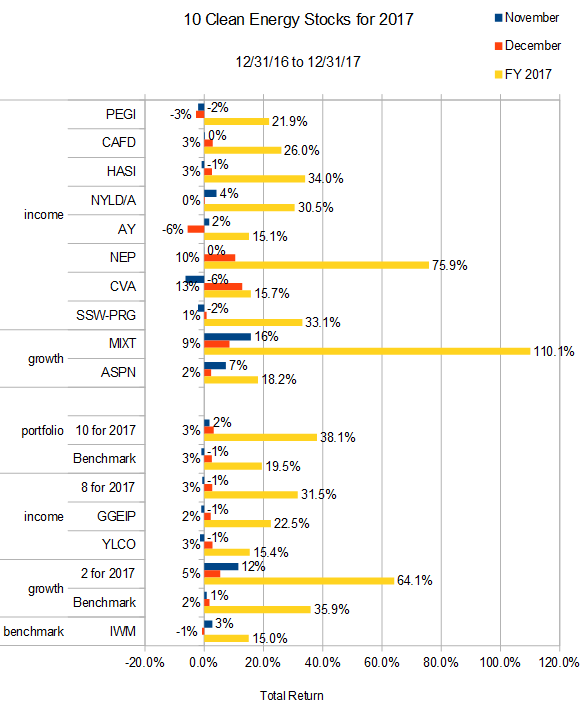

Even I am having trouble believing the 38% return this model portfolio turned in for the year. I certainly don’t expect that sort of performance in 2018. Nor did I expect it in 2017. I put together the 2017 list with an eye towards low risk in an uncertain environment. In the real portfolios I manage, I held a healthy allocation to cash. This is in part why my managed Green Global Equity Income Portfolio (GGEIP) gained “only” 23% (a preliminary number.) In the next week or so, I plan to take one more look back at how the 2017 picks did, and the news that drove their performance in November and December. Until then, you can find the data in this chart:

The risks for 2018 are at least as great as for 2017, and this year the stock market and corporations cannot look forward to a big tax giveaway from Washington. That tax giveaway has now happened, and, for the most part it is priced in. The prospects for another $1.5 trillion of US debt as a result of that tax giveaway will cause long term interest rates to rise faster than they would otherwise, and this, combined with increases in short term rates by the Federal Reserve could easily throw a monkey wrench in the stockmarket’s works this year. Not to mention the continued risk that the Trump administration will start a trade war trying to “negotiate” better trade deals with our allies, or start a real war with our rivals in order to distract the public from their problems at home.

The risks for 2018 are at least as great as for 2017, and this year the stock market and corporations cannot look forward to a big tax giveaway from Washington. That tax giveaway has now happened, and, for the most part it is priced in. The prospects for another $1.5 trillion of US debt as a result of that tax giveaway will cause long term interest rates to rise faster than they would otherwise, and this, combined with increases in short term rates by the Federal Reserve could easily throw a monkey wrench in the stockmarket’s works this year. Not to mention the continued risk that the Trump administration will start a trade war trying to “negotiate” better trade deals with our allies, or start a real war with our rivals in order to distract the public from their problems at home.

These ten clean energy stocks are generally lower risk than the market as a whole, but even they should be approached cautiously given the current macro environment. Hope for the best, but keep a healthy allocation to cash in case we get something less than the best.

Despite the risks, I think these 10 stocks are still quite reasonably valued, and if the market as a whole maintains an even keel, they should produce returns in the high single digits or the lower teens. Of course, I would have said the same last year, and look how wrong I was. If I’m wrong again this year, let’s hope it’s in the same direction.

Disclosure: Long PEGI, NYLD/A, CVA, AY, SSW, SSW-PRG, TERP, BEP, EVA, HIFR, GPP, FSLR, AQN.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Hey Tom – Any reason HASI is not on the list this year?

Just valuation, did not quite make the cut. More in my wrap up of last year soon.

Wonderful to see the new list! EVA and SSW look especially good to me. Many thanks for your work.

Tom Thanks for the 2018 selections Are you going to do a 2018 Motif or should a person use your 2017 version and customize it. I’m recommending it to a couple family members.

I just set up the Motif yesterday. Here it is: https://trader.motifinvesting.com/motifs/ten-clean-energy-stocks-for-201-Xs6dwiXV#/overview

If they are new to Motif, please use this link to sign up: http://r.mtf.io/7u2fC

I am jumping on the coattails of this and just set up a motif account. I have been reading the book The Clean Money Revolution, and went searching for a clean tech etf, that’s how I found this article. Thanks!

Glad I could help. And they just gave me free trading for a month in my Motif account because you signed up through my link. I appreciate that; I usually wait to make trades in that account until someone signs up.

Tom et al,

Ah, Christmas in January. I do look forward to this every year. Today I’ve been doing a little DD on those stocks in the list that I don’t already own. I loved the idea of a transmission and distribution REIT. I didn’t know such a thing existed. However, in reading up a little on InfraREIT, I’m not sure it’s a place I want to invest. I say that as Sharyland has been absolutely gouging its customers. That’s why TX stepped in an made them swap their local distribution with Oncor’s large scale transmissions assets. This article, while a little light of facts, reviews some of the woes of the customers: https://www.texasmonthly.com/energy/higher-power-sharyland/

Sharyland and InfraREIT have the same CEO. Essentially HIRF was set up to rent all the drop-down assets from from Hunt Consolidated to Sharyland. So how do you juice the earnings of your REIT? Jack up prices.

I literally never heard of any of this until about an hour ago. I’d love to hear a counter argument as I’d like to invest, but I don’t think I will based on what I’ve read. I will say, it doesn’t appear that they have much local distribution anymore, so perhaps it is now a non-issue?

I had not heard about the gouging of customers, but part of the reason they made the list is that now they are all transmission. I had my own problem with their former distribution assets, in that a lot of the customers were fracked oil wells. There still seems to be a little oil exposure, but most of that seems to be gone, with a greater emphasis on wind.

I think your concerns about management are legitimate, and if I were to drop any of these stocks for moral reasons, it would definitely be HIFR. Note that in the “Green” column of the table, HIFR is the only company with a “Somewhat.” On the other hand, its unique business (I don’t know of any other stocks totally focused on the electric grid since Fortis bought ITC) provides diversification that we would not be able to get in any other way. HIFR is also the stock best placed in the list to benefit from the recent tax cut.

Tom,

Thanks for the good work. Given the uptick in Solar demand, do you not find any of the stocks like FSLR/SEDG attractive.

Ajay

Solar is a rollercoaster, and I generally stay away. I like SEDG’s technology, but find the valuation stretched. I do personally have a small stake in FSLR (see the disclosure) but it’s not something I’ve researched enough to put a lot of money into. Each of the stocks in this list accounts for 5-10% of my portfolio. FSLR is something like 0.1%

Great list. I’m curious why SSW is on the list? Are they green?

They’re green in the sense that their ships are generally more efficient than competitors’, and because container shipping itself is the most efficient way to move goods long distances. I address this in more depth in this article: http://www.altenergystocks.com/archives/2016/11/shipping_panic_creates_preferred_arbitrage_opportunity/ … scroll down towards the end and read the section headed “Endnote: Is Seaspan Green?” See also the “Only Green” section of this article.

what do you think about HIFR’s latest presentation indicating they might de-REIT? they don’t make the tax cut sound beneficial to their plans.

I definitely did not understand the full implications of the tax cut for HIFR. While the pass through benefit I saw is real, there is a longer term risk that income may drop due to utility regulators clawing back some of the tax benefits. In the short term, there should be a small benefit. Longer term, there could be a cost.

Tom, noting that PEGI has a PE of 485, a Forward PE of 121, and a PEG of 11.75, help me understand the attractions of investing in it at this point in time.

P/E’s simply do not mean a lot with Yieldcos. You want to look at cash flow, and the Yieldco’s ability to pay its dividend based on current assets. Even assuming no growth by acquisition, PEGI should be able to pay its dividend for 15+ years based on its current assets, and there should be some residual value in those assets at the end of that time. 8% for 15 years is 120% of your current investment, or 150% with residual value. Not a great return, but that’s the worst case scenario. Best case is that the company can grow and replace those assets in the meantime, leading to stock price appreciation and 15-20% compound annual total returns as far as the eye can see.

Thanks for the explanation–this convinces me to buy given your recent results.

Although I like PEGI, past performance does not have a lot to do with future performance. Keep a healthy pile of cash this year… risks abound.

Dear Tom,

Thanks for all the valuable advice. Would it be possible to include or at least consider some EUR-denominated stocks next time? Personally, yes, I work in Europe, and I’m a bit reluctant to invest more of my EUR into USD-denominated stocks right now – to put it bluntly, I feel the political climate will drive USD further down relative to EUR. (And yes, hedging is an option, but it has a cost.) More generally, I think many of your US-based readers could be interested in stocks denominated in EUR or other foreign currencies, as I suspect I am not alone in fearing a further drop in the dollar.

I admit that this list is biased towards the stocks that are easier for me to research and buy. But here is a list of European stocks on my radar:

Umicore, Accell Group, Veolia, Vestas, Saeta Yield, Capital Stage, Munich RE.

UK Yieldcos: The Renewables Infrastructure Group, Foresight Solar, Bluefield Solar, Greencoat Wind, John Laing Infrastructure.

I just don’t know enough out their valuations make definitive picks.

Thank you very much! I’m long Saeta Yield (and have done well with it as of late).

(… but I will probably wait on most of the others until you do get interested in figuring them out).

Hey Tom,

Do you think PEGI is at a deep value level yet? With a yield over 9, hard for me to find a safer better income play?

Thanks for covering these.

Russ

Yes, I do. I have an article coming out on GTM today or tomorrow where I estimate that, if it were purchased at a valuation comparable to CAFD’s, the price would be $24 or more.

I didn’t see this article for 2018 over at GTM. Also, I didn’t notice your new pieces over at GTM! May I suggest some more co-ordination and cross-advertising for old and new readers?

Good suggestion, but not easy. GTM does have permission to republish my work, but they don’t usually do it. Unlike Seeking Alpha, Renewable Energy World, TalkMarkets, and AltEnergyStocks for that matter, they are focused on original content. But they pay well, and writing there gets me access to readers who would never go to an investing-only site, so I consider it a small price to pay.