Buying Innergex – Texas Was Bad, But Not That Bad

By Tom Konrad, Ph.D., CFA

Last week, I published this call to buy Innergex (INGXF, INE.TO) because investors had been overreacting to the losses from the February cold snap in Texas. The stock is up since then, but still seems a decent value.

Canadian Yieldco Innergex Renewable Energy (INGXF, INE.TO) took a big financial hit from the power disruptions in Texas in March.

It's complex, but their financial hedges on power prices for three of its wind farms ended up creating enormous liabilities - more, in fact, than two of their wind farms are worth. Two of their facilities also had benefits...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

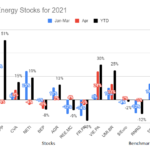

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

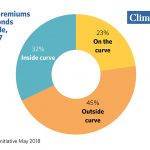

The Greenium: Growing Evidence of a Green Bond Premium

Highlights from the latest Q4 2017 Green Bond Report from the Climate Bonds Initiative: Two years of data observations examining green bond behavior in primary markets

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually allowing a more longtitudinal analysis as the market expands.

The Q4 2017 report covers USD15.1bn or almost 40% of the face value of labelled green bonds issued in Q4. 15 EUR and 8 USD labelled green bonds are...

Hannon Armstrong Declines to Raise Dividend, Sets 3 Year Guidance

Investors did not like Hannon Armstrong's (NYSE:HASI) fourth quarter earnings announcement last night. While core earnings were a little weaker than expected, that is not what has the stock trading down 11% today. What shocked investors is the fact that the company did not raise the dividend this year for the first time since the REIT went public, and it gave 3 year guidance which likely disappointed many investors.

Last month, I wrote,

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end...

First Solar and SunPower Lobby Shareholders to Sell 8point3 YieldCo

by Tom Konrad Ph.D., CFA

Will shareholders accept the deal?

On Monday, 8point3 Energy Partners, the joint YieldCo from First Solar and SunPower, entered into a definitive agreement to be acquired by Capital Dynamics.

When public companies are sold, it's almost always at a premium to the market price. It's that price premium that persuades shareholders to sell. So why would 8point3 (NASD: CAFD) shareholders accept a deal that offers them only $12.35, or 15 to 20 percent below the roughly $15 price CAFD has been trading around for the past three months?

To answer this question, we need a little history.

Jan Schalkwijk, founder...

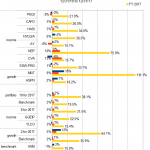

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Covanta and Hannon Armstrong Earnings

by Tom Konrad, Ph.D. CFA

Two more earnings notes I shared with my Patreon followers on February 18th.

Covanta Holdings (CVA)

Leading waste-to-energy firm Covanta Holdings (CVA) announced 2020 earnings today. There will be a conference call tomorrow morning, but here is my high-level impression:

The company managed well through Covid and ended the year within it's original pre-covid guidance. Metals and energy prices, as well as increased maintenance capital expenditures were a drag on results, but prices are improving and capital expenditures will fall in 2021.

The company is conducting a strategic review which will likely result in the sale of some underperforming...

Brookfield’s Yieldco Buying Spree

by Tom Konrad Ph.D., CFA

Last week, a Bloomberg reported on a rumor that Brookfield Asset Management (BAM) was in talks to buy Abengoa's (ABGOY) stake in its former YieldCo Atlantica Yield (ABY). Atlantica had been looking for a new sponsor for well over a year since parent Abengoa filed for bankruptcy.

Purchasing Yieldcos (companies that own clean energy infrastructure and use the cash flows to pay large dividends to shareholders) is not new to Brookfield. Not only has BAM long sponsored Brookfield Renewable Partners, LP (BEP), a limited partnership that has essentially been a Yieldco since before the term was...

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

Funding The Energy Transition at Clean Energy Credit Union

by Tom Konrad, Ph.D., CFA

With interest rates as low as they have ever been, I believe there is little point in small investors investing in bonds or bond funds, even if an allocation to fixed income is needed to match their investments to their ability and desire to take on risk. With little potential upside from interest, I believe it is better to take advantage of the added safety of federally backed insurance by depositing money in a bank or credit union savings account or certificate of deposit (CD) ladder.

We can do that and avoid having our deposits fund...

My Yieldco Raised Its Dividend With This Weird Trick

Tom Konrad CFA Clean energy yieldcos buck the general trend by paying out a large proportion of cash flow to investors, and rapidly increasing their dividends at the same time. The key to this trick has been their rapidly appreciating stock prices. High yield companies generally grow slowly, while high growth companies have low dividend yields. Normal companies grow by investing some profits in new business opportunities. Early stage growth companies typically retain all their earnings to invest in new business. More mature companies have fewer opportunities, and so share a larger proportion of...

How Much Could Another Yieldco Pay For 8point3?

by Tom Konrad Ph.D., CFA

When SunPower (SPWR) and First Solar's (FSLR) YieldCo, 8point3 Energy Partners (CAFD), went public two years ago, I used the financial nerd joke in 8point3's ticker symbol as a launching point to explain what "cash available for distribution," or CAFD, means.

In that article, I cautioned against the risks of using a short-term cash flow measure for long-term investing decisions. That risk is becoming more and more real for investors in 8point3 because the YieldCo is using short-term, interest-only financing to fund its long-term investments.

All of 8point3's debt matures in 2020, and refinancing that debt will...

Retail Renewable Energy Bonds Proliferating

by Sean Kidney Renewable Energy Finance via BigStockPhoto There has been a bit of interest recently about rapidly expanding options for retail investors to get involved in renewable energy projects. While we still see retail bonds as making a relatively modest contribution to the transition to a low carbon economy, they are important in engaging the public and creating awareness for green thematic investments which can only be good. Here’s a round up of some of the activity going on in the retail bond market (please note, this...

Pattern Energy Investors Enjoy The Breeze

by Debra Fiakas CFA This week Pattern Energy Group’s (PEGI: Nasdaq), the independent wind power generator, is scheduled to report sales and earnings for the quarter ending September 2015. The company has cultivated a strong following among analysts for a company its size. Nine estimate contributions have gone into a consensus estimate of $87.2 million in sales for the quarter, resulting in a net loss of a penny per share. If achieved the sales hurdle would represent 22% growth over the same quarter last year. A penny loss may not seem impressive, but it is substantially better than...

Greening of Utility Dividends

Investors looking for income have long relied on the stocks of electric utilities. Naturally cash generative utility companies have a history of generous dividend payout policies. However, for those investors who have a concern about sustainability or climate change, even utilities with the highest dividend yields may not be appealing.

We looked at a selection of nine utility companies with mixed achievements in terms of the percentage of renewable energy sources found in their retail sales of electricity. The intensity of renewable energy in utility portfolios varies considerably across the industry. Many utilities are grappling with legacy coal and oil infrastructure. Others are not favored...