Axion Power – A Battery Manufacturer Charging Forward

John Petersen Last week Debra Fiakas of Crystal Equity Research published an article titled "No Battery Producer Left Behind" that was based on old information about the relationship between Exide Technologies (XIDE) and Axion Power International (AXPW) and reached several erroneous conclusions. Since I'm a former Axion director, the stock is my biggest holding and I follow the company like a hawk, Tom Konrad asked me to clarify the record and present a high level overview of Axion's business history, stock market dynamics and technical accomplishments over the last four years. Since Tom's request is a...

Bargain Priced Alternative Energy Stocks

A review of Crystal Equity Research’s novel alternative energy indices found a number of companies that have delivered exceptional price appreciation over the last year. Several were reviewed in the recent post “Alternative Returns” on May 8th. Expectations for growth appeared to be driving the price movement, so the last post “Quest for Growth” featured four companies from the indices for which analysts have posted high growth predictions. Not unexpectedly some investors have already bid higher the stocks of those promising companies.

In this post we go back to the lists to find the companies with both high growth predictions and low price-earnings...

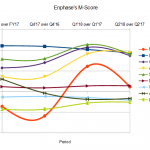

Hopping Off The Short Enphase Bandwagon

by Tom Konrad, Ph.D., CFA

Last week, I wrote that I'd taken a short position in Enphase Energy Inc. (ENPH). I have now closed out that position and don't intend to go short again.

My decision to go short was based on four factors:

I'm worried about risk in the overall market, and so am considering opportunistic short positions as a hedge.

Prescience Point Capital Management released a report accusing Enphase of earnings manipulation. The report seemed well-researched from a purely accounting point of view.

My favored indicator for avoiding companies which might be engaging in earnings manipulation, Beneish M-Score was...

Advanced Energy: Overlooked and Undervalued

Investors interested in renewable energy often get singularly focused on innovators new energy sources at the expense of companies that provide the nuts and bolts of the energy infrastructure. Advanced Energy Industries (AEIS: Nasdaq) is a stalwart of the electric power network, providing power conversion and control components that convert energy to the proper current for use by consumers and business. The company has a broad product line that has applications with a diverse customer base, including semiconductor manufacturers and chemical processing plants. The 2017 acquisition of Excelsys Holdings Ltd. based in Ireland added products targeted at medical and industrial applications.

As popular as Advanced...

Energy Storage on the Smart Grid Will Be 99.45% Cheap and 0.55% Cool

7.17.09 Storage Week John Petersen Infocast’s Storage Week was all I had hoped it would be, and more. While I thoroughly enjoyed serving on three discussion panels and was warmly received by roughly 250 attendees, including executives of companies that I've occasionally criticized, the most important value for me came from the opportunity to hear four days of high-level presentations by industry executives, national thought leaders and policymakers who repeatedly stressed that: From a utility perspective grid-based energy storage is the functional equivalent of an instantly...

Introducing PERGY

Impressed by the number of stocks in the Crystal Equity Research alternative energy indices that have delivered exceptional price appreciation, the last few posts have been on a quest to find fundamental characteristics that could give an advance signal of a future star. The post “Alternative Returns” on May 8th introduced the series identified future growth as a precursor of strong stock performance. The next post “Quest for Growth” on May 11th looked at stocks with above average growth predictions. Then the post “Alternative Bargains” looked at stocks in the alternative energy indices that are trading at below average price-earnings multiples.

There is a...

Grid-scale Energy Storage: Lux Predicts $113.5 Billion in Global Demand by 2017

John Petersen Last month Lux Research released a bottom-up evaluation of the cost effectiveness of eight energy storage technologies in six grid-scale applications throughout 44 countries, including all 50 U.S. states. Their report titled "Grid Storage under the Microscope: Using Local Knowledge to Forecast Global Demand" predicts that annual global demand for grid-scale energy storage will reach an astounding 185.4 gigawatt-hours (GWh) by 2017 and represent a $113.5 billion incremental revenue opportunity for an industry that currently generates sales of $50 to $60 billion a year. In the grid-scale sector alone, Lux predicts an average...

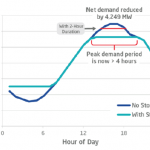

Democratizing the Grid

by Daryl Roberts

In a previous article I investigated the question of whether private sector capital was being stimulated sufficiently enough to build out renewable infrastructure on pace to reach climate goals. I found that on the upper end, giant institutional funds were only mobilizing a tiny fraction of their total Assets Under Management, due to regulatory constraints and uncompetitive yields. On the lower end, smaller scale funding seemed to be growing, with facilitation from intermediaries, fintech aggregation services, and increased access at lower levels to complicated derisking strategies.

But I now find reporting that capital is over-mobilized, that solar may...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Ten Solid, Clean Companies Ready For Stimulus, and Five That Aren’t

by Tom Konrad Last February, I wrote " I expect the Fed-induced reprieve to be fairly short lived, ten solid companies I'd be happy to buy more of if and when the bottom really falls out of the market." When I wrote those words, the Dow Jones Industrial Average was over 12,700. Now, it's around 8,500, and I doubt anyone remembers the "Fed-induced reprieve" I was referring to. The "bottom fell out" in September and October. On October 12, with the DJIA at 8451, I wrote "I don’t know where the market will go from here, but I...

Is AMSC Ready to Get Back to the Future?

Last week a jury found in favor of the United States government in a suit brought in 2013 by the Obama Administration against the Chinese wind turbine producer, Sinovel Wind Group (601558: Shanghai). Sinovel was found guilty of stealing technology from American Superconductor (AMSC: Nasdaq) that had supplied Sinovel with converter hardware and software solutions. Sinovel may have to pay hefty fines when the final sentencing step is completed in June 2018.

American Superconductor (now called AMSC) had already brought a private suit against Sinovel in China two years before the Justice Department filed its case. The China court dismissed the case for lack of...

Comverge, Diverge, or Merge?

Tom Konrad CFA Comverge (COMV) has a great residential demand response business. The company lacks focus, but the stock has significant upside as an acquisition target. As part of my ongoing series on energy management companies (see these articles on World Energy Solutions (XWES) and EnerNOC (ENOC)) I spoke with Comverge CEO Blake Young. The Comverge Advantage Comverge is the strong leader in residential demand response (DR,) one of the most cost effective grid stability solutions. Even within demand response, residential DR is an excellent niche, because working in the market for residential DR...

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...

ABB Group – A Cleantech Company?

Tom Konrad CFA Power and automation giant ABB, Ltd. (NYSE:ABB) was named Cleantech Corporation of the Year at the Cleantech Forum in San Francisco. The company has been focused on acquiring start ups in the cleantech space for the last couple of years, with two significant ones in 2010: Ventyx, a provider of IT systems to utilities, and Baldor Electric, the premier supplier of high-efficiency motors in the US. I very much like ABB's approach to cleantech. I'd even written about Baldor as a good way to invest in energy efficiency earlier in 2010 just a couple months before...

Alternative Energy Storage: Enabling the Smart Grid

America’s electric power grid is subject to immense inefficiencies that arise from the interplay between centralized power generation, local power consumption and on demand utility service. To put things into a broad perspective, the nameplate capacity of U.S. generating facilities is about 1 million Megawatts (MW), so if all of our power plants ran 24/7 we would have a theoretical annual generating capacity of 8.7 billion Megawatt-hours (MWh). Since demand for electricity fluctuates on both a daily and seasonal basis, total electric power generation in 2007 was only 4.2 billion MWh, or less than 50% of nameplate...

How to Invest in the Pickens Plan

A friend recently asked me how to invest in the Pickens Plan. I named a stock (see below). He then surprised me by saying "You are the fifth person I've asked, and no one else knew how. Several said it could not be done." You can invest in T. Boone Pickens's plan. Here's how: The Plan T. Boone's plan is both simple and audacious. We will build wind farms all over the Great Plains. Build the necessary transmission to get that electricity to cities, displacing natural gas used in electricity generation for the use in automobiles. This will...