ADM Separates Ethanol Business

Prelude to a spin-off?

by Jim Lane

The Archer Daniels Midland Company (ADM) is breaking news of breaking off their ethanol unit…and a tumbling 40% decline in profit.

In Chicago, Archer Daniels Midland Company reported their financial results for the quarter ended March 31, 2019, but most interesting to us, they are looking at separating their ethanol business with the option of spinning it off completely. They are also taking other actions to restructure and deal with challenges they say include weather issues and trade pressures.

ADM announced a “series of measures to continue to underpin long-term-value creation” which included:

“First, to meet growing customer...

Are Ethanol Companies Risky Investments?

By Neal Dikeman, Partner, Jane Capital Partners LLC, and Founding Contributor, Cleantechblog.com. He has no investments in or financial incentive related to ethanol or ethanol stocks. Are ethanol stocks risky long-term investments? We think they are. Don’t get me wrong, I’m a big fan of ethanol blended fuels for a whole host of reasons, I just don’t like ethanol as an investment. Here are six solid reasons to be very, very cautious. 1. Demand vs. supply – As with most regulatory driven markets, the demand has come on very fast behind the advent of renewable...

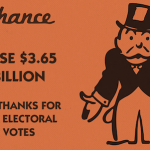

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

Green Plains’ Cattle Drive

As quickly as the ethanol producer jumped into the cattle business, Green Plains (GPRE: Nasdaq) has sold off half of its Green Plains Cattle Company to a group of investment funds for $77 million. Operating at six locations in Colorado, Kansas, Texas and Missouri, the company has the capacity to feed 355,000 head of cattle each year. The cattle business contributed $271 million to total revenue in the most recently reported quarter ending June 2019, delivering a modest operating profit near $7.3 million.

There has been considerable stress in the feed cattle industry. The number of cattle in feedlots is down compared to last year, an unusual development...

US Ethanol Industry Upset With 2019 Renewable Fuel Standard Proposal

The 2019 proposed US Renewable Fuel Standard proposed volumes attracted a major raspberry from the ethanol industry.

As the American Coalition for Ethanol noted:

“Unfortunately, EPA continues to take actions which undermine the letter and spirit of the statute and harm the rural economy. While refiners are reporting double-digit profits, the heart of America is being left behind. Farmers are losing money while refiners have the best of both worlds: fat profit margins and minimal RFS compliance costs. EPA needs to discard its refiner-win-at-all-costs mentality and get the RFS back on track.”

“While the proposed rule purports to maintain the 15-billion-gallon conventional...

Green Plains to Adopt Syngenta’s Enogen Corn Ethanol Tech Across Fleet

by Jim LaneGood news arrives from Minnesota that Syngenta has partnered with Green Plains (GPRE) to expand its use of Enogen corn enzyme technology across GPRE’s 1.5 billion gallon production platform.

The Enogen backstory

Enogen corn enzyme technology is an in-seed innovation available exclusively from Syngenta and features the first biotech corn output trait designed specifically to enhance ethanol production. Using modern biotechnology to deliver best-in-class alpha amylase enzyme directly in the grain, Enogen corn eliminates the need to add liquid alpha amylase and creates a win-win-win scenario by adding value for ethanol plants, corn growers and rural communities.

We reported in January that Syngenta had reached...

Aemetis’ Cellulosic Ethanol From Orchard Waste Project

by Jim Lane

There were more than 100 presentations at ABLC last week and not a clunker amongst them, but if I were to point the reader’s attention at one or two that stood out from the rest because of the short-term or long-term implications, I’d start with the news from Aemetis (AMTX) that they are embarking now on a $158 million cellulosic ethanol plant — to be built in Riverbank, California, in partnership with LanzaTech.

Cellulosic ethanol is selling for such a high price in California right now — the value jumps north of $4.00 per gallon at times —...

A Simple Fix To Farmer’s Tariff Woes?

by Jim Lane

As most know by now, the US and China have fired opening salvos in a trade war, with the US targeting a range of commodities including steel and aluminum, and China retaliating with, to date, stiff tariffs on a range of agricultural products, but primarily hitting soybeans and corn because of the volume of trade in those agricultural goods. Overall, China imports $24 billion of agricultural goods from the US and is a leading export market for the US.

The trade wars prompted North Dakota farmer Kevin Skunes, president of the National Corn Growers Association, to state:

“Farmers are...

Beyond ZEVs: The Negative Emission Vehicle

by Jim Lane

Wandering the halls at the BIO World Congress and later to be seen again at ABLC NEXT this November, we ran across one of the most interesting technologies relating to ethanol production and markets we have seen in a month of Sundays, perhaps two months’ worth.

The problem

First, let’s revisit the problem. There’s simply too much ethanol being produced for the markets to absorb, given the Trump Administration’s massive cutbacks in US ethanol targets —In the resulting massively oversupplied market, the inevitable has happened, ethanol producers, growers and the Midwestern economies are being crushed. And they thought they...

DowDuPont To Exit Cellulosic Biofuels

by Jim Lane

In Delaware, DowDuPont (DWDP) announced that it intends to sell its cellulosic biofuels business and its first commercial project, a 30 million gallon per year cellulosic ethanol plant in Nevada, Iowa. The Nevada project is still going through start-up.

In an official statement, the company said:

As part of DowDuPont’s intent to create a leading Specialty Products Company, we are making a strategic shift in how we participate in the cellulosic biofuels market. While we still believe in the future of cellulosic biofuels we have concluded it is in our long-term interest to find a strategic buyer for our...

Ethanol Blends: High Octane, Low Carbon, High Controversy

by Jim Lane, Biofuels Digest

For every ethanol blend everywhere these days, there seems to be a war on.

A war in India over 22% blends. A war in Brazil over exactly what baseline blend ratio (somewhere int he 20s) is ideal. A war on in Europe to roll back first-gen ethanol to around 2% blending. A war in New South Wales, Australia over whether there should be any ethanol mandating at all. A war in the US as conservatives aim to haul belnding down to 9.7% while ethanol producers have clearly aimed at a 15% baseline blend.

And so on and...

Trump Takes Down Ethanol in Pincer Move

by Debra Fiakas, CFA

The Trump Administration is using tariffs on China goods as a trade war tactic to pressure China into relenting to U.S. trade policy demands. Unfortunately, the fallout has been heavy and widespread. Farmers have taken the heaviest hits as China has dropped orders for corn and soybeans. Ethanol producers have been ensnared in the trade war skirmish as well and in recent weeks have been caught an uncomfortable ‘pincer-like’ squeeze by the Trump Administration.

Trump’s Environmental Protection Agency has continued its practice of granting waivers to oil and gas refiners, eliminating the requirement to blend biofuel with the refiners’ petroleum...

Cosan: Brazillian Sweetheart

by Debra Fiakas CFA The first thing we think about Brazil in the context of alternative energy is sugar cane and ethanol. In the last growing season Brazil producer 596 million tons of sugar cane, a feat that secured Brazil’s position as the largest sugar cane grower in the world. About 55% of the crop was used to producer ethanol and the balance ended up as sugar. Brazil’s sugar cane industry association has predicted that despite a severe drought, the 2014-2015 growing season will be even more productive with expected sugar cane production in the range 632...

Biofuels Industry Reacts To The New RVO Requirements

by Jim Lane

What a whirlwind weekend after the U.S. Environmental Protection Agency announced their final renewable volume obligations (RVO) under the Renewable Fuel Standard program for 2019. “It’s just numbers,” some say, but oh no, not in the biofuels world. It’s never just numbers. This time it’s about waivers, fixing the damage done, and ensuring a bright future for biofuels. It’s about hollow chocolate bunnies and two steps back for some.

French mathematician Rene Descartes is best known for “I think, therefore I am,” but he also said “Perfect numbers, like perfect men, are rare.” So true in this case as not...

REX American: Culturally Frugal

by Debra Fiakas CFA Among the surviving public ethanol producers in the U.S. is REX American Resources (REX: NYSE). Based in Ohio, REX American is an ethanol fuel producer with owned nameplate capacity near 215 million gallons per year. Additionally, the company distributes by-products of the ethanol production process, including distiller grains and non-food grade corn oil. REX has full or partial ownership in six ethanol production plants located in the Ohio, South Dakota, Illinois and Minnesota. The company relies on corn feed stock for its dry milling ethanol production process. Like any other ethanol...

EPA’s 2018 Renewable Fuel Targets Disappoint Producers

In Washington, the Environmental Protection Agency released its final Renewable Fuel Standard renewable volume obligations for 2018. The agency finalized a total renewable fuel volume of 19.29 billion gallons , of which 4.29 BG is advanced biofuel, including 288 million gallons of cellulosic biofuel.

As the Renewable Fuels Association explained: “That leaves a 15 BG requirement for conventional renewable fuels like corn ethanol, consistent with the levels envisioned by Congress in the 2007 Energy Independence and Security Act. The 2018 total RFS volume finalized today represents a minor increase (10 million gallons) over the 2017 standards, and a modest increase...