Amyris’ Missing Magic

by Debra Fiakas CFA Since the end of August last year shares of renewable chemicals developer Amyris (AMRS: Nasdaq) have been in a steady decline. Since falling through a line of price support near the $2.50 price level in early December 2014, it appears there is no safety net for AMRS. The stock set a new 52-week low in the third week in January 2015. Unfortunately, a popular technical indicator, the average directional index, is providing a very strong indication that the stock could fall even further. With its stock chart providing no hints at a reversal in...

Countdown To Codexis’ Day Of Reckoning

It is earnings season and bio-catalyst developer Codexis (CDXS: Nasdaq) is expected to report fourth quarter and year-end 2017 financial results in the coming weeks. The three analysts who regularly publish estimates for the company expect a nickel profit in the quarter on $23 million in total sales of the company’s custom protein catalysts. Codexis is still perfecting its proprietary platform technology called CodeEvolver, but has already delivered an array of unique enzymes that help drive critical biological processes for its customers.

Codexis does not have a good track record in terms of meeting the consensus estimate. The company has only cleared the...

Bioplastics Maker Avantium’s IPO Plans

Jim Lane Here’s our 10-minute version of the filing, slightly re-organized to make sense to Earthlings instead of aliens from the Planet Prospectus. In the Netherlands, bioplastics maker Avantium is planning an initial public offering and listing of all shares on Euronext Amsterdam and Euronext Brussels. The company expects to raise up to €100 million (USD$106 million) and complete the offering by the end of the current quarter. More than half of the offering has already been secured via commitments from cornerstone investors. Avantium’s YXY technology converts plant-based sugar into chemicals and plastics, including 2,5-furandicarboxylic acid, a precursor...

Amyris In The Age Of Rapid Change

by Jim Lane

Last month, Amyris (AMRS) and Chevron (CVX) announced that Novvi and Chevron have entered into an agreement to jointly develop and bring to market novel renewable base oil technologies. Novvi is Amyris’ JV with Cosan (CZZ) to produce targeted hydrocarbon molecules from plant sugar for automotive, industrial, marine, and construction applications at unbeatable economics. Think lubricants for engines and machines.

Since launching its first commercial production in 2014, Novvi has been steadily increasing its base oil production to keep up with robust and growing demand for a variety of automotive, marine and industrial applications. Meanwhile, Chevron has one of...

Amber Means Caution But BioAmber Means Go

Jim Lane In Canada, BioAmber (BIOA) recorded net income of $4.8M for Q2 2016 and an operating loss of $1.0M on revenues of $2.5M. Revenues were up 73 percent over Q1 and 637 percent compared to Q2 2015. For those less familiar with the company, it produces succinic acid from sugar at a first commercial-scale plant which opened recently in Sarnia, Ontario. Succinic acid has a small existing global market but can be converted into a variety of chemical building blocks used to produce a range of plastics, paints, textiles, food additives and personal care products. If for...

Leather Without The Cow

Flokser launches Artificial Leather based on DuPont Tate & Lyle, BioAmber ingredients Jim Lane In Canada, BioAmber (BIOA) announced that the Flokser Group has successfully developed an innovative artificial leather fabric using bio-based materials supplied by DuPont (DD) Tate & Lyle Bio Products and BioAmber. Flokser has launched this new synthetic leather fabric under its SERTEX brand. The novel fabric comprises a polyester polyol made from BioAmber’s Bio-SA bio-based succinic acid and DuPont Tate & Lyle Bio Products’ Susterra bio-based 1,3-propanediol. Flokser’s artificial leather fabric has 70% renewable content and delivers improved performance. It provides better scratch resistance...

Spring Blossoms: Amyris First Quarter Earnings

Jim Lane Lily flowered tulip 'Maytime' photo by Tom Konrad In California, Amyris (AMRS) announced net income of $16.4M on revenues of $6.2M for Q1 2014, after reporting a $32.6M loss in Q1 2013 on revenues of $9.0M. The change in net income was primary due to a non-cash benefit relating to outstanding convertible notes, a result of a decrease in the Company’s stock price at 3/31/14 compared to the stock price at 12/31/13. In a release accompanying the results, the company highlighted that it: Achieved combined...

From Fuel To Fudge

by Debra Fiakas CFA This week the last reminder of the renewable fuels business that was once called Solazyme will be gone. The old Solazyme has abandoned the goal of producing renewable fuels using the oils from algae. Instead, under a new name TerraVia, the company is directing its algae cultivation and harvesting knowhow toward growing edible algae for food and personal care products. To make the change complete the old stock symbol ‘SYZM’ gives way this week to a new trading symbol ‘TVIA.’ No doubt there is more than just a little hope in Terra...

Beets to Gas

by Debra Fiakas, CFA

In recent weeks management from Global Bioenergies (ALGBE: EURONEXT)made the rounds among New York City investors. The French specialty chemical developer is trying to win new friends in the U.S. for its bio-isobutene made through the fermentation of organic materials. Isobutene, also called isobutylene, is a four-molecule hydrocarbon that is a foundational chemical in a wide range of common products from gasoline additives to cosmetics. Until recently, isobutene was made exclusively in the crude oil refinement process. It is one of the many by-products of crude oil refining that helps pad the profit margins of big oil...

Mitsui Raises Stake In BioAmber JV

Jim Lane In Canada, Mitsui has invested an additional CDN$25 million in the BioAmber (BIOA) joint venture for 10% of the equity, increasing its stake from 30% to 40%. Mitsui will also play a stronger role in the commercialization of bio-succinic acid produced in Sarnia, providing dedicated resources alongside BioAmber’s commercial team. BioAmber will maintain a 60% controlling stake in the joint venture. “Mitsui is continuously committed to renewable chemistry and through our increased equity stake we will be more actively involved in joint venture management and sales, leveraging our global sales platforms,” said Hidebumi Kasuga, General Manager, Specialty...

Corbion Bids To Acquire TerraVia

Corbion Bids To Acquire TerraVia

In California, Corbion has made a $20M stalking horse stock and asset purchase bid for TerraVia (TRVA).

The purchase agreement provides TerraVia with a binding bid of $20 million in cash along with the assumption of certain liabilities, which is subject to higher or otherwise better offers. As part of the transaction, Corbion will be assuming the ongoing financial obligations of the business and its joint venture ownership, therefore the total financial commitment is expected to be in excess of the cash purchase price. Through this proposed transaction, TerraVia employees, who bring with them a wide...

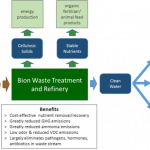

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Dyadic Sells Industrial Technology Business To Dupont

Jim Lane As Dyadic cashes out of industrial biotech and retains a C1 license for pharma, DSM and Syngenta also announce a partnership. Companies are girding their loins for the long haul. The Digest takes a look, In Florida, DuPont (DD) Industrial Biosciences will acquire substantially all of the enzyme and technology assets Dyadic’s (DYAI) Industrial Technology business for $75 million, including Dyadic’s C1 platform, a technology for producing enzyme products used in a broad range of industries. DuPont has granted back to Dyadic co-exclusive rights to the C1 technology for use in human and animal pharmaceutical...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Why Traffic Lights Are Turning Green For BioAmber

Jim Lane As many technologies pivot or delay, one train keeps chugging on its route to biosuccinic acid, and markets like BDO, resins and polyols. What is it about the business model that keeps on working? What can every integrated biorefinery learn from its approach? In Minneapolis, BioAmber (BIOA) just announced a contract to supply a minimum of 80% of PTTMCC Biochem’s total bio-succinic acid needs until the end of 2017. PTTMCC Biochem is a joint venture established by Mitsubishi Chemical and PTT, Thailand’s largest oil and gas company, to produce and sell polybutylene succinate (PBS),...

Gevo’s Glow

Specialty chemicals developer Gevo, Inc. (GEVO: Nasdaq) is celebrating a string of market wins for its renewable chemicals and fuels. Since its beginning thirteen years ago this month, Gevo has been doggedly perfecting its synthetic biology and chemical technologies and turning it into products that are in demand by consumers and industry. Last week shareholders were treated to an announcement by the U.S. Environmental Protection Agency (EPA) raising the amount of isobutanol for on-road use to 16% blend level from 12.5%. As a producer of renewable isobutanol Gevo will be a direct beneficiary of the EPA action. Following directly on the heels of that news,...