The Future of Alternative Fuels: Ethanol

Besides a slew of clean car announcements connected to the North American International Auto Show, the alt energy topic that has made media and blog headlines most often over the past week has been alternative fuels. We are thus going to run a 2-part series on alternative fuels this week as follows: ethanol today and coal-to-liquids tomorrow. ETHANOL: INVESTOR FRIEND OR FOE? I’m going to start this post with a statement of opinion: I don’t really like corn-based ethanol (as an investment), I never have, and, as a result, I haven’t followed this space as closely as...

Kaydon: Profits Behind the Scenes

Debra Fiakas Most investors when they consider the alternative energy sector think about the big solar photovoltaic manufacturers or the ethanol producers. Engineering firms like Kaydon Corporation (KDN: NYSE) rarely come to mind. With special expertise in fluid processes, Kaydon is an indispensable partner in a variety of alternative energy projects such as wind, renewable diesel and ethanol plants. The company earned a 12% net profit margin on $4645 million in total sales in the year 2010. As impressive as that might be the really bright spot in Kaydon’s financial picture is its ability to generate cash ...

Gevo: a 5-Minute Guide

Jim Lane Address: 345 Inverness Dr. South; Bldg. C; Suite 345, Englewood, CO 80112 Year founded: 2005 website: www.gevo.com Stock: NASD: GEVO Type of Technology(ies): Gevo has two proprietary technologies that combine to make it possible to retrofit existing ethanol plants to produce isobutanol, a four carbon alcohol which serves as a hydrocarbon platform molecule. We have developed a robust industrial scale yeast biocatalyst to produce isobutanol without typical byproducts operating at parameters equivalent to commercial ethanol producers. The second piece of technology is a separations unit that operates continuously and removes isobutanol...

When Will the Fog Lift of Biofuel Investors?

Jim Lane Delays and cancellations photo via Bigstock Investor flights GEVO, SZYM, AMRS take off delayed by fog. How soon will the potential of three of the hottest companies in the field be realized? What are the key milestones coming up for the industrial biotech’s Gold Dust Triplets? In Colorado, Gevo (GEVO) reported its Q4 and full-year 2012 results this week and now the Q4 news for the gold-dust trio of Amyris (AMRS), Solazyme (SZYM) and Gevo is in certainly the most highly-heralded...

Ten Solid Clean Energy Companies to Buy on the Cheap: #7 Deere & Co....

The first and last word in any discussion of biofuels should always be "Feedstock." Feedstock is the "Bio" out of which biofuels will eventually be made, whether it be corn, sugar, jatropha, algae, palm oil, switchgrass, forestry waste, or municipal solid waste. Before the era of peak oil, we lived in a world of plenty, which meant that we could squander energy, not only by driving Hummers, but by feeding energy intensive products such as corn crops to livestock, and by dumping "free" sources of energy such as garden waste and used cooking oil into landfills. The era of...

Sketches of DuPont’s Cellulosic Ethanol Project in Nevada, Iowa

Jim Lane It towers above the surrounding Iowa countryside like the Launch Assembly Building lords it over Cape Canaveral it’s the new DuPont (DD) cellulosic ethanol project, on the outskirts of the town of Nevada. Functional yet inspiring, imposing yet accessible when it opens before year end 2014 it is sure to be a monumental addition to the cellulosic biofuels landscape. Last week we wrote: “There are strategic reasons to develop this new industrial bioscience business in central Iowa not just the “we’d love to have you, wages are low, cost of...

BYOB: Bio-Yachts On Butanol

Jim Lane In Washington, the National Marine Manufacturers Association (NMMA) announced support of the use of fuels blended with up to 16 percent biobutanol in recreational marine engines. This decision follows five years of evaluation performed by NMMA with the American Boat and Yacht Council (ABYC), under the direction and guidance of the U.S. Department of Energy and Argonne National Laboratory, and in partnership with the US Coast Guard, Gevo and Butamax. During this time, the NMMA has gathered a great amount of data supporting the viability of isobutanol as the preferred renewable fuel blendstock for gasoline-powered marine engines....

Solazyme: Microbes in the Dark

by Debra Fiakas CFA The previous post “Solazyme's Detours on the Way to Algae Biofuel” began a discussion of Solazyme, Inc. (SZYM: Nasdaq), a self-described “oil developer” targeting three commercial markets that are known heavy oil users: chemical and fuel, nutrition and skin care. Solazyme touts its ability to serve customers with oils tailored to their specific needs, creating a paradigm shift from the status quo where formulators and manufacturers must design around the limitations of conventional oils. Solazyme is attempting to harness the oil producing capability of microalgae - the most diminutive...

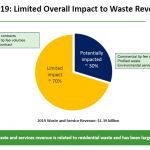

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Pacific Ethanol Completes Permitting for Planned Ethanol Plant in Boardman, Oregon

Pacific Ethanol, Inc. (PEIX) announced that it has received all necessary permits to begin construction on a 35 million gallon per year ethanol facility at the Port of Morrow, located on the Columbia River near Boardman, Oregon. The Company further stated that it expects to begin construction, which should take approximately 12 months, within the next thirty days. The Oregon ethanol facility will provide ethanol for the Pacific Northwest gasoline markets, helping to increase supply in that area and provide a CO2-reducing fuel for the transportation sector. It is expected that the plant's distillers grains will be sold...

Top 10 Biofuels Predictions for 2012

Jim Lane Rewind to 2011 with a “best of” New Year’s story? Bah, humbug! Today, Biofuels Digest looks forward to the sunny possibilities of 2012 in bioenergy. As the sunset of 2011 gives way to the dawn of 2012, here at the Digest we resist the holiday temptation to look back over the challenges and highlights of the year gone by, and instead once again roll out our crystal ball as we list the Digest’s 10 Biofuels Predictions for 2012. Top 10 Biofuels Predictions for 2012 10. Advanced biofuels capacity surges to 1 billion gallons, globally. We...

KiOR IPO: One Year Later

by Debra Fiakas CFA One year ago biofuel developer KiOR, Inc. (KIOR: Nasdaq) raised $150 million in through its initial public offering. The anniversary seems like an appropriate time to revisit the company’s progress - and valuation of KiOR shares. KiOR’s claims its demonstration plant proves its proprietary catalysts dramatically accelerate the conversion of biomass into hydrocarbons. KiOR’s bio-crude can then be put through conventional “cracking” processes to transform the bio-crude to gasoline and other petroleum products. The company claims yields of 67 gallons of fuel per bone dry ton of biomass such as wood...

3 Alternative Energy Stocks You Need to Know

In the face of a declining overall energy market today, three of our favorite alternative energy stocks posted strong gains on high volume. The Oil Services HOLDRs ETF (OIH) was down 2% and the PowerShares WilderHill Clean Energy ETF (PBW) was down 1.7%. Indeed, the vast majority of the energy stocks that we track were in the red. But bucking the trend were two energy stocks that we have profiled in the recent past and a third company that we will begin covering today. First on the list is our favorite wind energy play, Welwind Energy International...

Abengoa Bioenergy files for Chapter 11

In Missouri, Abengoa (ABGB) Bioenergy US Holding, LLC filed for Chapter 11 bankruptcy relief in the US Bankruptcy Court for the Eastern District of Missouri on behalf of itself and 5 of its US bioenergy subsidiaries. The companies involved in the filings include the US holding company; companies that own and operate four of Abengoa Bioenergy’s six US starch ethanol plants; as well as various support/service companies for Abengoa’s US bioenergy operations.

This action follows the filing of two separate involuntary bankruptcy proceedings in Nebraska and Kansas earlier this month concerning the company’s starch ethanol facilities located in Ravenna and...

Living Endangeredly- Q2 Biobased Earnings Roundup

by Jim Lane

In hand we now have the latest earnings reports from what you might call the 8 Pathfinders – eight publicly traded stocks whose second quarter results offer insights into the health and performance of the advanced bioeconomy as 2019 heads towards its closing crescendos.

Our 8 Pathfinders – In the world of global renewable diesel at scale, Neste (Neste.HE); pure-play enzymes, Novozymes (NVMB); In pharma and synbio, Codexis (CDXS); as a hybrid play in advanced fuels, Aemetis (AMTX); in advanced marine and jet fuels, Gevo (GEVO); for biodiesel and hydrocarbons, Renewable Energy Group (REGI); in advanced began foods,...

Rentech’s Wood Saw Hits a Knot

by Debra Fiakas CFA Last week Rentech, Inc. (RTK: NYSE) revealed plans to idle its wood pellet production facility in Wawa, Ontario Canada. To operate efficiently the plant requires additional repairs and upgrades beyond the replacement of conveyors that was completed in Fall 2016. Beside the fact that the additional repairs were not included in the regular capital budget, Rentech management has apparently determined the expenditure is not economic given profits from Wawa. When Rentech reports financial results for the fourth quarter ending December 2016, shareholders will be treated to an asset impairment charge for the Wawa facility....