Three Water Recycling Stocks

by Debra Fiakas CFA The water series continues as we attempt to get arms around the very large market to package, deliver, purify, treat, and recycle water. As the need for water increases with population and economic activity, the use of waste waters has become an imperative. In this post we look at three companies helping to clean up, reclaim and otherwise recycle waste water. Ecosphere Technologies, Inc. (ESPH: PK) has introduced several water solutions that can be used in agriculture, mining, industry, or municipal applications. The company’s flagship Ozonix Technology is a chemical-free system to recycle...

Boiler Maker in Need of a Shot

by Debra Fiakas, CFA

A reserve split is in the works to keep shares of Babcock & Wilcox Enterprises(B&W) listed under the symbol BW on the NYSE. The stock price of this storied environmental engineering had slipped below the Exchange’s minimum price requirements. Ten shares will be melded into one beginning July 23, 2019.

Reverse merger math alone will not solve B&W’s problems. One hundred and fifty two years in business, B&W has been providing environmental technologies and services for energy and industrial customers since the company’s first boiler was sold right after the American Civil War. The company boasts that Thomas Edison was one of...

The Worst Waste

Jim Lane Peter Brown of FFA Fuels, promotes his company these days with the pithy slogan, “Fuels from the Worst Waste Around.” Which of course raises the legitimate question, what is the worst waste, and can we find a use for it? Discussions of worst waste will usually focus on the obvious say, landfill or the odious say, medical or nuclear waste. Toxicity and longevity are typical concerns, and that’s one of the reasons why nuclear energy remains controversial to this day. No Waste in Nature As LanzaTech’s Jennifer Holmgren observed in a recent article by...

Kadant: Will Investors Clean Up With This Bargain Green Stock?

Everybody likes a bargain. Investors really like a good cheap buy. A review of our four alternative energy industries revealed three stocks trading below industry average multiples of forecasted earnings. This is the second article in the series, thee first looked at Ormat (ORA:NYSE). A couple of weeks ago shares of Kadant, Inc. (KAI: NYSE) registered an particularly bullish formation - at least from a technical standpoint. A ‘triple top breakout’ was formed in a point and figure chart, suggesting demand for the stock outpaces supply. Given the new momentum that has developed, the stock could reach...

Mantra’s Promise of Innovation

by Debra Fiakas CFA How often do we see the crowd rooting for the underdog? You could hear the cheers for Mantra Energy (MVTG: OTC) last week at the Marcum Microcap Conference in New York City. Mantra is a developmental stage company pursuing technologies to harness carbon dioxide for energy. Of course, the company has no revenue and therefore no earnings. Indeed, its technologies are so unique and as yet at such an early stage some might find them almost fanciful. Yet for some investors, a fanciful underdog is even better than another. Mantra sees itself...

Phycal Captures CO2 Funding for Biofuel

by Debra Fiakas CFA As part of its program to promote beneficial reuse of carbon dioxide, the Department of Energy awarded a total of $27.2 million ($3.0 million in the first phase and $24.2 million in a second phase) to a consortium led by alternative energy developer Phycal, Inc. (private). According to the DOE website, Phycal is to develop an integrated system to produce biofuel from microalgae cultivated with captured carbon dioxide (CO2). The biofuel is to be blended with other fuels for power generation or as drop-in diesel or jet fuel. It is a bit of...

Greenhouse Gas Management Stocks: Key To A Real Climate Change Portfolio?

There has been a lot written lately about how to turn climate change into an investment opportunity, including on this site. Not all of it is, however, especially useful or relevant. In the worst cases, commentators have ascribed the 'climate change investment opportunity' label to just about any industry out there, indiscriminate of whether or not there really is a strong and direct connection. If you are seriously interested in playing the climate story, you should stay focused on near and medium term opportunities with real and tangible links to what is currently going on with the climate...

The Low Cow-bon e-Cow-nomy

Jim Lane This month in Finland, a team of intrepid researchers herded one thousand European cows one-by-one into a glass “metabolic chamber” to measure their methane emissions, digestion, production characteristics, energy-efficiency, metabolism, and the microbial make-up of their rumens. The Project is known as RuminOmics, but if it had been titled The Truman Show II: When the Cows Come Home, we wouldn’t have been a bit surprised. The Cow Emission Crisis. No Kidding Around. The ultimate aim of the study was to find an optimal, low-emission, high-yield cow, and the team noted in its premise that of all greenhouse...

BioNitrogen: Valuable Technology, Management Questions

by Debra Fiakas CFA My last post outlined how Bion Environmental Technologies, Inc. (BNET: OTC/QB) is transforming livestock waste into organic fertilizer. Bion is not the only aspiring fertilizer producer. BioNitrogen Holdings Corp. (BION: OTC/PK) was recently patent protection for a process to produce urea from stranded natural gas. Instead of burning off the unwanted gases, oil and gas operators can turn it into an economically viable by-product. There is more than just cash flow at stake for oil and gas producers. Burning off stranded gas increases harmful emission that can lead to penalties in the...

OriginClear: Metals out of the Muck

After the worst of the wind and rain had died down from Hurricanes Harvey and Irma, and people began making their way back home, it became apparent that citizens of Texas and Florida would have more worries. The U.S. Environmental Protection Agency disclosed that at least thirteen toxic waste sites in Texas were flooded and damaged by Hurricane Harvey and another forty-one Superfund sites were negatively affected. Legacy contamination includes lead, arsenic, polychlorinated biphenyls, benzene and other carcinogenic compounds from historic industrial processes. After Hurricane Irma over six million gallons of wastewater reportedly flowed out to the coast and...

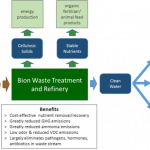

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

A Concrete Proposal

The Economist recently had a story on how the cement industry is beginning to confront the fact that the industry produces 5% of the world's emissions of greenhouse gasses. Carbon dioxide is emitted not only by the fossil fuels used to create the heat used in the creation of cement, and by the chemical reaction in that process. Unfortunately for us, cement is a remarkably useful building material, not least as a structural material which can also serve as thermal mass in passive solar buildings. All the large cement firms: Lafarge, Holcim, and Cemex (NYSE:CX) have joined a voluntary...

The EPA’s Carbon Rule: Likely Stockmarket Winners

By Harris Roen Greenhouse gas emissions by economic sector A seismic shift in the power generation landscape is starting to sink in. It has been two weeks since the EPA announced its new proposed carbon rules, one of the flagship efforts of the Obama Administration to address climate change. This shift is meant to move the country in the direction of inevitable changes coming to the energy economy. It is important for investors to know which companies and sectors stand to benefit from the...

What Shouldn’t Be in a Green Energy Portfolio

The London Accord took a look at what portfolio theory would suggest as the most effective ways to address Climate Change. Knowing which technologies don't make the cut is at least as useful as knowing which technologies do. Tom Konrad, Ph.D., CFA I recently looked at a paper from the London Accord which used portfolio theory to recommend the best mixes of technologies to deliver different levels of carbon abatement. The most useful technologies to achieve the needed levels of carbon abatement were Forestry, Hydropower, Biofuels, Wind, Efficiency, and Geothermal. I suggested stocks that investors might consider to invest in...

OriginClear Gambles on Marketing Program

by Debra Fiakas, CFA

Last week waste water treatment developer OriginClear (OCLN: OTC/QB) announced pilot projects for rental of its commercial water systems for pool cleaning. The company has several patents to its credit, protecting its innovations. OriginClear has developed a proprietary catalytic process to clean up solids from waste water as well as an oxidation technology to eliminate microtoxins in water. Unfortunately, the company has struggled to extract value from its efforts. OriginClear has yet to report profits. Indeed in the most recently reported fiscal year ending December 2019, revenue of $3.588 million only barely covered cost of goods of $3.217 million, let alone operating expenses that...

Southern Company’s Carbon Capture Testing

by Debra Fiakas CFA Coal emissions photo via BigStock An electric utility of Southern Company’s size - $38.3 billion in market capitalization - is not among the typical company covered in the Small Cap Strategist weblog. Southern (SO: NYSE) owns and operates six dozen power plants in the southeastern U.S., generating 12,222 megawatts of power from a mix of fossil fuel, hydroelectric, nuclear and solar plant assets. The company earned $2.68 in earnings per share on $16.5 billion in total electric power sales. Sales dipped in 2012...