Dyadic International (DYAI.PK), A Stock To Avoid

Tom Konrad, Ph.D., CFA Dyadic International hopes to use proprietary gene discovery to revolutionize cellulosic biofuel and pharmaceuticals. Investors should stay away. Dyadic International (DYAI.PK) says they are applying their "proprietary enabling biotechnologies for multi-billion dollar markets in industrial enzymes, biofuels and biotherapeutics." A very exciting prospect, and just the sort of thing I've long warned investors to avoid. In short, they are a company with gigantic claims and not a lot of track record to back them up. Why I Care (I don't, really) In our survey of readers, one respondent asked that I write more about stocks...

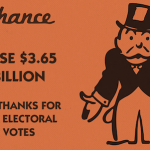

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

Earnings Round-Up: ADM, Green Plains, Syngenta

Jim Lane Green Plains In Nebraska, Green Plains (GPRE) announced net income for the quarter was $42.2 million compared to net income of $25.5 million for the same period in 2013. Revenues were $829.9 million for the fourth quarter of 2014 compared to $712.9 million for the same period in 2013. Net income for the full year was $159.5 million compared to $43.4 million for the same period in 2013. Revenues were $3.2 billion for the full year of 2014 compared to $3.0 billion for the same period in 2013. Fourth quarter 2014 EBITDA was $90.7 million compared to...

Green Plains, Green Profits

by Debra Fiakas CFA Green Plains Renewable Energy, Inc. (GPRE: Nasdaq) is one of the few U.S. ethanol producers to turn a consistent profit. The company is half way through its fifth consecutive profitable year. Sales in the most recently reported twelve months totaled $3.4 billion, on which the company earned $40.5 million in net income. During this period Green Plains generated $100.0 million in operating cash flow. Tracing Green Plains profits requires a bit of effort by investors. The company channels its products through a marketing and distribution division. Thus while, ethanol production...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...

A Modest Proposal: Cellulosic Beef

The Future is Cellulosic It is now widely accepted that the future of ethanol is cellulosic: Rather than distilling corn for ethanol to fuel our cars, accepted wisdom is now that we will be able to replace a large fraction of our current fuel consumption with ethanol distilled from agricultural and forestry waste, as well as dedicated energy crops, such as switchgrass and hybrid poplar. Cellulosic ethanol also has the potential to alleviate the greatest stumbling block of corn ethanol as a potential replacement of gasoline: that there is simply not enough of it. Corn ethanol will only be...

Biofuels Industry Reacts To The New RVO Requirements

by Jim Lane

What a whirlwind weekend after the U.S. Environmental Protection Agency announced their final renewable volume obligations (RVO) under the Renewable Fuel Standard program for 2019. “It’s just numbers,” some say, but oh no, not in the biofuels world. It’s never just numbers. This time it’s about waivers, fixing the damage done, and ensuring a bright future for biofuels. It’s about hollow chocolate bunnies and two steps back for some.

French mathematician Rene Descartes is best known for “I think, therefore I am,” but he also said “Perfect numbers, like perfect men, are rare.” So true in this case as not...

The Battle for California’s Ethanol Market

by Debra Fiakas CFA For all the fuss, investors might think California’s ethanol market is another Gold Rush. The Midwest-based ethanol producers are up in arms over California’s attempt to set standards for renewable fuels sold in the state. My recent post, describes legal maneuverings by South Dakota-based ethanol producer Poet, LLC and others to block a ‘carbon intensity’ standard imposed by the California Air Resources Board (CARB). Under the CARB standard the carbon intensity of alternative fuels includes elements for power and other inputs as well as transportation and distribution. The formula CARB is...

Dyadic International (DYAI.PK): Update

Tom Konrad, CFA Representatives of Dyadic International (DYAI.OB) were quite upset when I called the company "A Stock to Avoid." The company has now released audited financial statements for 2007 and 2008. The lack of such statements was one of the several reasons I said to avoid the company. Should I retract my article? Mark Emalfarb, Dyadic International's CEO sent me an email this morning with attached audited financial statements for 2007 and 2008, saying, I hope that you will act responsibly as journalists and publish a retraction to your article "A Stock To Avoid" which Tom...

Cellulosic Ethanol and Advanced Biofuels Investments

There's much excitement about second generation biofuels made from cellulosic feedstocks and algae, be they cellulosic ethanol, biodiesel, biocrude, or electricity from biomass. There will be winners, but they may not be the technology companies. Tom Konrad, Ph.D., CFA At the 2009 Advanced Biofuels Workshop, there were two major themes: developing new feedstocks, especially algae, and the development of new pathways to take biomass into products such as biocrude, which can be used in exiting oil refineries. Big Market, Many Competitors The current federal Renewable Fuel Standard requires the use of 36 million gallons of biofuels, including at...

Lessons From Tesla: Building An Ethanol Market

Jim Lane E85 ethanol? Been stuck with low sales for years – with producers pointing to “no market access”. Yet, Tesla was faced with “no market access” and built its own market. What lessons can be learned? Last week, Tesla Motors (NASD:TSLA) announced the completion of its transcontinental US Supercharger Corridor, a network of stations that enable Model S owners to (somewhat) rapidly recharge their Teslas on a cross-country drove. And intrepid Tesla blgger Hamish McKenzie relayed the news last week that two Tesla Model S sedans completed a 76-hour coast-to-coast all-electric crossing. The news follows...

Veridium Updates License for Exclusive Rights to CO2 Bioreactor

Veridium Corp. (VRDM.OB) announced its execution of an amended license agreement with Ohio University ("Ohio") for its patented bioreactor process for reducing greenhouse gas emissions from fossil-fuelled combustion processes. Veridium's original license with Ohio provided for non-exclusive rights to the technology for the purpose of processing exhaust gas streams from electrical utility power generation facilities, and exclusive rights to the technology for applications involving all other sources. The amended license agreement increases the scope of Veridium's license to provide for exclusivity in all applications, including electrical utility power generation facilities.

Current Structure of the US Ethanol Industry “Problematic”, Says the IMF

The International Monetary Fund released its Spring 2007 World Economic Forecast today. Fuel Vs. Food There is a short sub-section in Appendix 1.1 ("Recent Developments in Commodity Markets") that I thought might be worth sharing with you. If you download the PDF version of the report and scroll down to page 44, you will find the said sub-section under the heading "Food and Biofuels". In it, the IMF notes that food prices (as measured by its own food price index) rose by 10% in 2006, driven partly by a poor wheat crop in certain countries but...

Ethanol Producers Climb to New Highs

Shares of ethanol producers extended their recent rally Monday, as oil refiners continued their rush to substitute ethanol for a toxic gasoline additive before the summer driving season shifts into gear. The enthusiasm for ethanol is tied to the fate of methyl tertiary butyl ether (MTBE), an additive mixed into gasoline to reduce pollution. However, studies have found that MTBE to be carcinogenic if it seeps into a water source. States are increasingly banning MBTE due to contamination concerns. Companies wishing to comply with new laws and worried about the potential for legal liability are...

ADM raises capacity of N. Dakota biodiesel plant

Archer-Daniels-Midland Co. (ADM) s increasing the capacity of a biodiesel plant under construction in North Dakota to 85 million gallons a year, a company spokesman said on Wednesday. ADM originally announced the plant in Velva would produce 50 million gallons of biodiesel a year using canola oil. ADM decided to increase capacity to take advantage of economies of scale, said Greg Webb, vice president of public affairs.

Baron’s Thinks Archer Daniels Stock to Rise on Ethanol Harvest

Barons profiles Archer-Daniels-Midland Co. (ADM) in the April 3rd edition. They feel that ADM shares are poised to climb further, literally fueled by its dominance of the ethanol market as investors seek alternative energy investments. Archer Daniels was believed to have secured a 50-cent per gallon increase in ethanol contract pricing to $1.85 per gallon in recent negotiations. Given ethanol price rises seen in the commodities market, Archer Daniels could reap significant further increases in its next round of talks for October contracts.