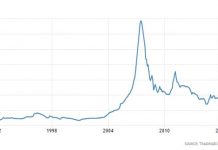

The post Yellow Cake Debut described the capital raising effort of one of the newest players in the uranium supply chain. Yellow Cake leadership brought the aspiring intermediary to the capital market at a critical time for uranium producers. The uranium market has been in an extended trough period since the industry peak in 2007. At that time considerable development had been undertaken and capacity was beginning to generate sufficient supply to create stockpiled inventories. As this bloated condition persisted, in 2011 the nuclear power and its uranium supply chain were shocked by a Pacific Ocean tsunami that led to a nuclear spill at the Fukushima Power Plant in Japan.

The world view of nuclear power shifted seemingly overnight, causing Japan as well Germany and others to take nuclear power plants offline. Demand for uranium dried up. These many years later, the industry is still working through excess inventories. Selling prices for U308 were gutted after the Fukushima incident and have remained at historic low levels.

As a consequence company valuations have remained stubbornly stuck near historic lows. As shown in the table below, the average of the group is a value of 2.03 times book value.

| RECENT | PRICE/ | PRICE/ | PRICE/ | |||

| COMPANY | SYM | PRICE* | SALES | CSH FL | BK VAL | |

| Altius Minerals | ALS: TO | $9.82 | 12.36 | 29.84 | 1.71 | |

| Azincourt Energy Corp. | AAZ: V | $0.07 | na | neg | 1.41 | |

| Berkeley Energia Ltd. | BKY: L | $54.47 | nm | neg | nm | |

| Cameco Corp. | CCJ: NYSE | $10.86 | 2.63 | 6.58 | 1.16 | |

| Energy Fuels, Inc. | UUUU: NYSE | $2.32 | 6.41 | neg | 1.52 | |

| NexGen Energy Ltd. | NXE: NYSE | $1.93 | na | neg | 5.16 | |

| Paladin Energy Ltd. | PDN: ASX | $0.13 | 3.85 | neg | na | |

| Peninsula Energy Ltd. | PEN: ASX | $0.19 | 2.97 | 46.38 | 0.76 | |

| Uranium Energy Corp. | UEC: NYSE | $1.62 | na | neg | 4.06 | |

| UR-Energy, Inc. | URG: NYSE | $0.68 | 2.32 | 18.26 | 2.19 | |

| Westwater Resources | WWR: Nasdaq | $0.40 | na | neg | 0.29 | |

| Sector Average | 5.09 | 25.27 | 2.03 | |||

| *Price and revenue converted to USD | ||||||

It may well be an opportune time for investors to look at the uranium sector. Multiples are near historic lows, providing investors with good bargains. More importantly there is some evidence that undervaluation might be near an end, providing investors with the prospect of near-term price appreciation. Our signal for a shift in the industry cycle off the trough, is in the production decisions of uranium suppliers. In December 2017, JSC National Atomic Company Kazatomprom, considered to be among the lowest-cost uranium producers in the world, announced plans to cut production by 20% or about 11,000 tons over three years beginning in 2018. Kazatomprom’s announcement was followed a month later by a similar decision from Cameco (CCJ: NYSE, CCO: TSX) to suspend production at its McArthur River mine beginning January 2018.

These are two of the largest uranium producers in the world. It is widely expected that with this production taken off-line, the last of uranium inventories will be burned off by existing demand. Prices are expected to rebound and could even appreciate to the point where production capacity will be taken back out of mothballs. It is expected that production will drive the sector going forward and the days of inventory influence are coming to an end.

In this new age which uranium producer is better than the next? Historic profitability could be one way to sort out the best uranium company. This would give an investor a company with a known track record for delivering profits when in production. Alternatively, investors could choose the companies with a ready production capacity rather than companies with development projects focused on new deposits. Those companies that had shuttered established operations will find it easier to jump back into production and begin delivering profits to the bottom line.

More importantly the recovery could dramatic, taking the uranium sector to record levels. Global nuclear power reactor requirements are increasing in the long-term. There are currently 465 nuclear power reactors in operation around the world. Since Fukushima there has been a shift in the use of nuclear power from developed countries – U.S., France, Germany and Japan – to Asian countries – China, India. There are currently 58 nuclear power reactors under construction around the world, representing a 16% increase in nuclear capacity. There are another 157 reactors in the planning stages in China, India, South Korea and Russia that are expected to be operational by 2030. This would add another 42% increase in production capacity.

With global warming and carbon emissions continuing to make the headlines, nuclear power is likely to become a larger portion of future energy. Nonetheless, investors may have some time for due diligence. There are signs the uranium sector is poised for a recovery, but so far there has been a limited response from investors. Early birds still have a chance to find that special uranium worm.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries. Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.