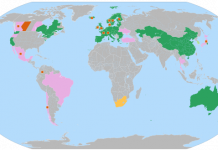

The French electric utility EDF [CAC:EDF] announced today that it is setting up a €300 million ($396 million) carbon fund to help meet its regulatory requirements under the EU ETS, Europe’s regulatory framework to control CO2 emissions. Carbon funds allow companies to make investments that create CO2 emissions reductions in emerging markets, such as upgrades to industrial operations or renewable energy projects, and use the credits generated thus to meet regulatory requirements in their home jurisdictions. This is a good way to concurrently reduce compliance costs at home and foster environmentally-friendly investments in emerging economies. I have discussed recent development in this mechanism of the Kyoto protocol, called the Clean Development Mechanism, in a previous post. Carbon Funds are nothing new – the World Bank has been running carbon funds for some time now. What is interesting is that a growing numbers of companies and financial institutions are going at it without the support of governments and the World Bank, indicating a certain level of maturing in that market. As discussed in a previous post on carbon finance, certain players in the North American financial services industry, most notably Goldman Sachs [NYSE:GS] and Morgan Stanley [NYSE:MS], have begun positioning themselves in anticipation of climate change regulations on this side of the pond. Opportunities tied to emissions trading exist in a number of areas such as brokerage, investment banking, information provision and strategic consulting.