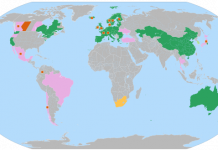

This post was supposed to be about coal-to-liquids (CTL), but I came across interesting info yesterday after opening a former colleague’s mail that I thought would make for a more interesting post. The CTL piece will thus have to wait a bit. What was in the package was a hard copy of the January/February 2007 edition of CNBC European Business. This edition is dedicated to climate change, but, more importantly, to how some firms are positioning themselves to benefit from the markets that will be created as a result of regulatory and other actions to tackle greenhouse gas emissions. Of all of the climate change-related pieces in this edition, I would recommend 2 in particular: “The Green Klondike��?, discussing London’s Alternative Investment Market (AIM) and its prominence as a center of alt energy activity, and “The Top 50 Low-carbon Pioneers��?, which lists 50 firms that could see some upside from efforts to reduce greenhouse gas emissions. AIM The visibility of London’s AIM increased significantly post-Sarbanes-Oxley, as many small firms chose to list there instead of the NASDAQ due looser listing requirements and lower costs. It also helped that London was Europe’s principal financial center, with a savvy investor class and plenty of liquidity. What most people within the alt energy community also know is that the AIM has become, over the past 3 years, a powerhouse of clean tech and alt energy financing. For those interested, New Energy Finance recently released a research note (PDF document) detailing how alt energy companies listed on the AIM have fared so far. AIM and Investing in Climate Change Besides being a locus of clean tech activity generally, the AIM also sits at the confluence of 2 converging movements: (a) European efforts to tackle change via market-based means such as emissions trading and (b) growing investor interest in all things alt energy and clean tech. The AIM is therefore becoming a meeting point for firms with solutions to climate change and investors with a strong interest in seeing the solutions these firms have to offer succeed. The second article that I mentioned initially lists 50 companies that CNBC identifies as having positive exposure to climate change (i.e. that are positioned to benefit as regulations to reduce greenhouse gas emissions are enacted and/or tightened). Of the 50, there are a number of large-cap companies for which, I believe, climate change really won’t be a make or break issue…at least in the foreseeable future. There are also a number of alt energy companies that don’t have a specific focus on climate change per se. I thus decided to go over the list and pull out, for you, 4 AIM-listed firms with a clear strategic focus on climate change and carbon finance, or emissions trading in carbon credits. These companies can be considered carbon finance pure-plays, and are likely at the fore of a movement likely to grow significantly in the next decade. The companies are: Climate Exchange plc [LSE:CLE]: Owns the European Climate Exchange, responsible for 80% of exchange-traded volumes of carbon dioxide in Europe, as well as the Chicago Climate Exchange, the only carbon dioxide emissions trading platform currently functioning in the US. Goldman Sachs has a 10% stake in Climate Exchange.  Ecosecurities [LSE:ECO]: Ecosecurities sources, develops and trades carbon dioxide credits. The company finances deals that generate emissions credits, mostly in emerging markets, which can then be sold to mostly developed market companies to meet their compliance obligations.

Ecosecurities [LSE:ECO]: Ecosecurities sources, develops and trades carbon dioxide credits. The company finances deals that generate emissions credits, mostly in emerging markets, which can then be sold to mostly developed market companies to meet their compliance obligations.  Camco International [LSE:CAO]: Camco advises companies on how to originate carbon credits in emerging and transiotion economies, with a particular focus on the Russian and Chinese markets as well as Africa and the CEE.

Camco International [LSE:CAO]: Camco advises companies on how to originate carbon credits in emerging and transiotion economies, with a particular focus on the Russian and Chinese markets as well as Africa and the CEE.  Low Carbon Accelerator [LSE:LCA]: LCA is a private equity fund dedicated to businesses that reduce carbon emissions. Its biggest investor is ABM Amro. No chart. There are a number of other interesting companies on the list of 50, including good plays on the wind, solar, biofuels and fuel cell markets. The alt energy and clean tech sectors will see some upside related efforts to solve climate change, although climate change is not necessarily the primary driver in this space. The 4 securities listed above have business models that are truly focused on greenhouse gas reduction and emissions trading, and the expertise they are developing will no doubt be worth a lot of money one day, especially as emissions trading extends to North America.

Low Carbon Accelerator [LSE:LCA]: LCA is a private equity fund dedicated to businesses that reduce carbon emissions. Its biggest investor is ABM Amro. No chart. There are a number of other interesting companies on the list of 50, including good plays on the wind, solar, biofuels and fuel cell markets. The alt energy and clean tech sectors will see some upside related efforts to solve climate change, although climate change is not necessarily the primary driver in this space. The 4 securities listed above have business models that are truly focused on greenhouse gas reduction and emissions trading, and the expertise they are developing will no doubt be worth a lot of money one day, especially as emissions trading extends to North America.

Dear Charles

I think you have made a prescient call by recommending Climate Exchange PLC.

Trading volumes in European carbon are growing almost daily….ECX has now captured 90+% of all exchange-traded CO2…Soon, the rest will migrate to them…Soon, again, OTC volume should move over to the transparency of an exchange.

Finally, Climate Exchange PLC’s fortunes should double again if/when the US ever adopts a cap-and-trade system ala the EU. Rumors are running rampant that Bush’s State of the Union address on Tuesday may just include a brave new view towards GHG regulation. If not, it is clear that the Democratic Congress is going to offer up many bills to enact GHG regulation. Bush may veto, but he is a lame duck, and all the candidates for 2008 are going to be pro-regulation of some sort…McCain, who is the Republican front leader today, is in this camp. Whoever the Democratic candiate is, he/she will be similarly inclined to take action. So, the political momentum is not in doubt…Just a matter of whether anything substantive can or will be enacted in this administration.

Moreover, there are rumors that Goldman Sachs has increased its stake in Climate Exchange PlC.

The next year (if not next week) should be quite interesting for Climate Exchange PLC