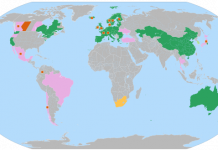

Few investors outside of Europe have ever heard of the term carbon finance. What some investors might have heard, however, is that Goldman Sachs took, on September 20, 2006, a 10.1% stake in a little outfit known as Climate Exchange plc (LSE:CLE) for approximately $23 million. Admittedly, by Goldman Sachs standards, that’s peanuts. Not to be outdone, Morgan Stanley unveiled a plan on Thursday October 26 to invest a whopping $3 billion in global carbon markets over the next few years…now that’s the kind of money that gets folks talking at the water cooler, especially when it’s in something they’ve never heard of. What is carbon trading and how does it work? Emissions trading is an innovative concept that was first used in the US to reduce emissions of the acid rain-forming gases NOx and SO2. It entails placing a cap on the total emissions of a given pollutant within an imaginary ‘bubble’ (e.g. an industrial district, a city, a state, or, in the case of carbon dioxide (CO2), the whole planet), and allowing emitters of that pollutant to sort out, among themselves, who should emit how much of that limit based on factors such as the nature of their industries, the efficiency of their operations, periodic requirements for higher commercial output, etc. Lets look at an example. Imagine an industrial district with 3 plants operating in it. Local regulators determine that a maximum of 5 units of pollutant X can go into the atmosphere for any one year. Plant A purchases emissions rights for 3 units, Plant B for 1 and Plant C for 1. Plant A later decides to invest in a new technology and only emits 2 units per year as a result. At the same time, Plant B receives a big order and must scale up production, causing it to increase its output of pollutant X to 2 units. Plant A sells its spare unit to Plant B, and nothing changes for Plant C – there are still no more than 5 units of pollutant X going into the atmosphere, but the allocation of those 5 units has changed. The environmentally-optimal emission level thus never gets exceeded but the market, rather than regulators, decide on the most efficient way to divide up that limit among participating entities. The Global Carbon Market An interesting thing about CO2 and other greenhouse gases (GHGs) is that they are global pollutants, meaning that the end result of their presence in the atmosphere in large quantities will be the same whether they came from a Chinese power plant or an American SUV. This spells great possibilities for coordination between national regulatory bodies and the eventual setting up of a global marketplace for CO2 emissions rights. The market for CO2 emissions currently exists in 2 forms: (a) in jurisdictions where there are legislative frameworks with formal targets in place to control GHGs, such as in the EU, carbon markets, as they are called, form the cornerstone of regulatory implementation, and (b) in areas where there are no regulations but certain market players adopt voluntary emissions targets, such as in the US, carbon trading is one tool used to meet those targets. The actual exchanges used to carry out carbon trades are known as climate exchanges, although many trades also occur in OTC markets. In the EU, the Emissions Trading Scheme (ETS) came into force on January 1, 2005. That year, the first one during which selected facilities were subjected enforceable regulatory limits, the value of the market reached $8.2 billion. By half-year 2006, carbon finance information provider Point Carbon reported that the ETS’ value already stood at $12.5 billion. Point Carbon estimates that the global carbon market, including both the ETS and voluntary initiatives such as the Chicago Climate Exchange (CCX), will be worth upwards of $27 billion by the end of 2006, up from around $12 billion in 2005 and $377 million in 2004. Now the ETS will continue to account for the bulk of this until other jurisdictions adopt mandatory GHG targets, and that’s where it gets interesting. Most folks outside of environmental or political punditry circles probably didn’t pay too much attention to the signing into law of Assembly Bill 32 in California just a few weeks back. AB 32 will impose firm caps on GHG emissions in that state, the 6th largest economy in the world, starting in 2012, and will in all likelihood rely on carbon trading to achieve its targets. The Regional Greenhouse Gas Initiative (RGGI) is another interesting development that has been in the works for some time. RGGI will cap GHG emissions from power producers in Northeastern and Mid-Atlantic states and establish a trading system starting in 2009. Even more interesting is the growing number of commentators that now predict federally-imposed GHG emissions targets sometime in the near- to medium-term. Seeing as the US (a) accounts for about 25% of global GHG emissions and (b) houses the most liquid financial markets in the world, we could be talking about some pretty big money here. A recent Financial Times article estimates that, should consensus be attained on a plan to fight global climate change between the largest emitting jurisdictions, expenditures could top $1,000 billion within 5 years. Seen under this light, those recent announcements by Morgan Stanley and Goldman Sachs look increasingly less like a means to placate environmentalists and earn a little goodwill, and increasingly more like pretty sound strategic positioning to cash in on a pretty significant business opportunity. How Do I Play This? Admittedly, this is mostly institutional stuff and that’s probably where a lot of the action will be. But retail investors can definitely get a piece of the pie, too. One good way to play this is to be on the lookout for companies with promising technologies that are sure to get big uptake under the right regulatory scenario. Citigroup Investment Research, in collaboration with the World Resource Institute, a highly respected DC-based environmental think-thank, released this study a few months ago discussing 12 large-cap companies they believe are well positioned to cash in. The most significant potential upside probably rests, however, with small-cap clean tech pure plays discussed daily on of blogs such as this one. There is an increasing amount of those companies out there, both publicly-listed or at various stages of the VC funding process, and, if you pick wisely, have sufficient nerve and the right amount of patience, you will probably do pretty well. For the more cautious folks out there, a growing number of large industrial concerns like GE, DuPont, Siemens, BP, etc are looking at this and investing big money in R&D to position themselves and their technologies. But today I want to discuss a pretty unique way to play the climate bonanza: buying directly into climate exchanges. Climate Exchange plc (disclosure: I don’t own it, but am definitely looking at it), the company in which Goldman took a 10.1% stake back in September, has had a pretty nice run since the entry into force of the ETS (see 3 charts below). The company owns both the European Climate Exchange (ECX), the entity with the biggest share of the European exchange-traded carbon market (~80% of volume), and the Chicago Climate Exchange, the only outfit with a functioning carbon trading platform in the US. Volumes traded on both exchanges are growing, fast. In the 8 months ended 31 August 2006, CCX traded approximately 8 million metric tonnes of carbon in comparison with 0.53 million metric tonnes traded over the same period in 2005. ECX saw trading volumes of 257 million tonnes in the first eight months of 2006 compared with volumes traded from April 2005 (commencement

of trading) to December of 95 million tonnes. Now that’s all nice and well. But imagine what would happen to the stock of the only (so far) owner of a carbon trading platform in the US if the Feds were to announce a climate change plan. Even without that, AB 32 and the RGGI should provide plenty of volume in the next few years even before they enter into force, as targeted companies will surely want to hone their carbon trading skills before they’re faced with enforceable targets.

Closing Thoughts on Carbon Finance To those who kick and scream every time they hear the words climate change or Kyoto, keep these two things in mind. First, there is far more scientific consensus on this then Fox News would have you believe – GHG’s will one day be regulated . Second, it’s not all downside. You need to see this as Goldman is seeing this – as a big opportunity. Is there going to be a massive transfer of wealth away from inefficient and dirty companies towards cunning investors who understand carbon trading? That remains to be seen but I, and some big institutions, strongly believe that to be the case. I see a great opportunity in carbon finance for those who can navigate the waters ahead.

Closing Thoughts on Carbon Finance To those who kick and scream every time they hear the words climate change or Kyoto, keep these two things in mind. First, there is far more scientific consensus on this then Fox News would have you believe – GHG’s will one day be regulated . Second, it’s not all downside. You need to see this as Goldman is seeing this – as a big opportunity. Is there going to be a massive transfer of wealth away from inefficient and dirty companies towards cunning investors who understand carbon trading? That remains to be seen but I, and some big institutions, strongly believe that to be the case. I see a great opportunity in carbon finance for those who can navigate the waters ahead.

Emissions Trading: An Investment Opportunity?

Trend: Emissions trading is a free market approach to pollution control that may grow rapidly in the near future as laws are passed reflecting concerns about climate change. Charles Morand at Alternative Energy Stocks describes how emissions trading wo…

I have not been able to track down any financial info on this company. It trades on the pink sheets, which is immediate reason for caution. It’s a very interesting prospect, but where can I find any info on this company?

I AM WORKING IN PROYECTS OF THIS KIND IN MEXICO COULD YOU SEND ME INFORMATION OF COMPANIES THAT COULD INVEST CAPITAL OR GIVE LOANS?

I LIVE IN CHIHUAHUA,MEXICO

who regulates the carbon market??? please answer my questions

Zalak,

Governments ‘regulate’ carbon markets. They distribute the carbon permits at the outset (either through a grandfathering process or through an auction), monitor actual emission levels and withdraw permits if they want to lower total emissions.

Comments are closed.